Wheat Market Outlook and Prices

The Wheat Market Outlook is provided by Exceed Grain Marketing.

Wheat Market Outlook – September 29, 2025

Western Canadian Markets Highlights / Key Events

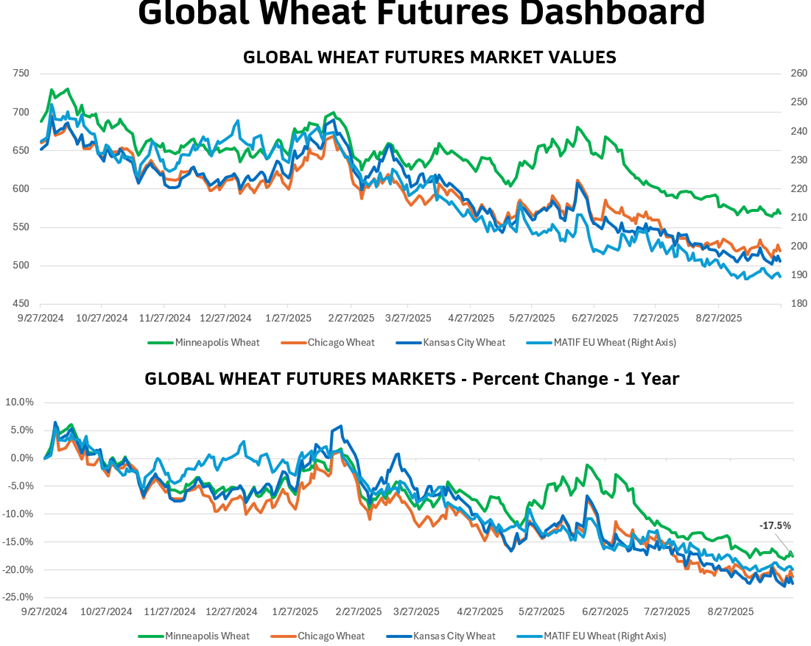

WHEAT FUTURES

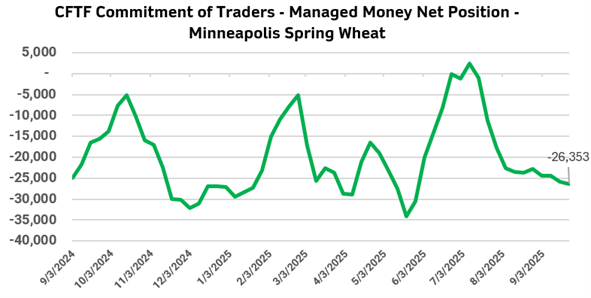

Minneapolis Spring Wheat

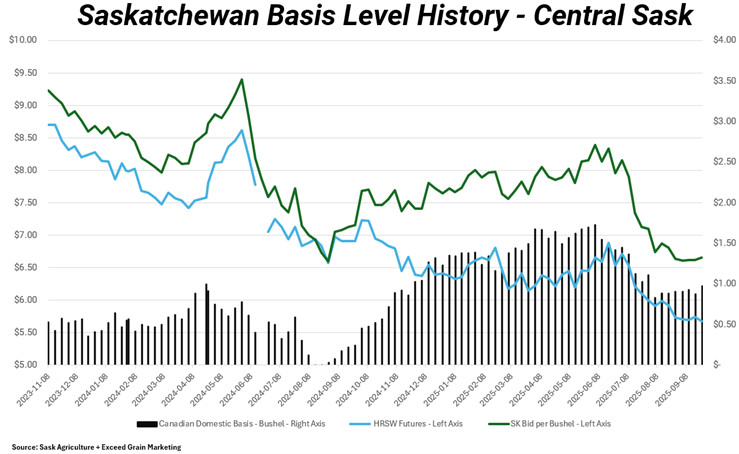

- Futures sit at $5.68 per bushel on the U.S. based contract. New contract lows were made last week at $5.62 per bushel on Sept. 23, 2025.

Kansas City Wheat

- Kansas City wheat was at $5.05 per bushel this morning. KC wheat sits above its contract low of $4.97 per bushel set on Sept. 22, 2025.

Chicago Wheat

- Chicago wheat sits at $5.19 per bushel. There is a new contract low of $5.07 set on Sept. 23, 2025.

European Wheat

- MATIF wheat futures at $188.75 euro per tonne. New contract low set at $187.75 euro per tonne on Sept. 23, 2025.

Global Wheat Market Notable Items

Global

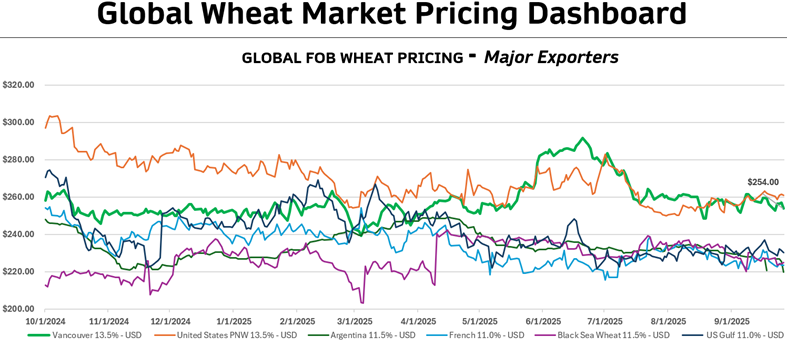

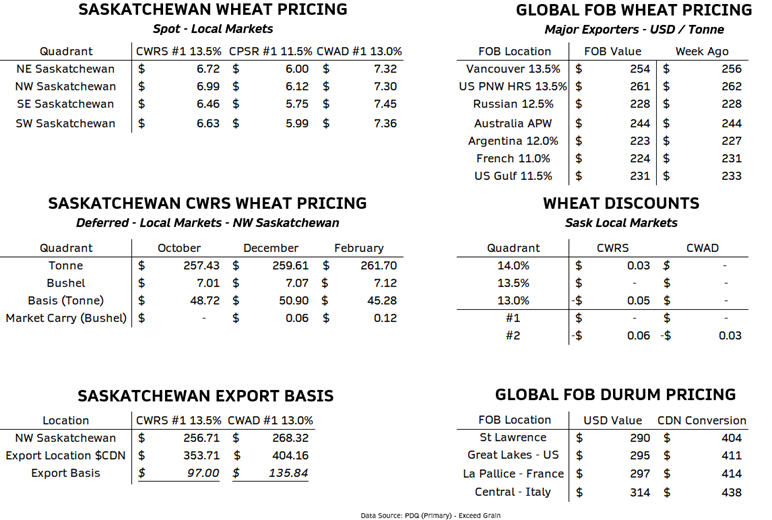

- Wheat values dropped slightly week-over-week in most locations except for Russia and Australia. Argentina adding more supply to the global market through reduced export tariffs kept any appreciation out of the market.

- Major sales this week include a 600,000-tonne purchase of Black Sea wheat by Algeria, sparking some demand from the region and keeping prices intact.

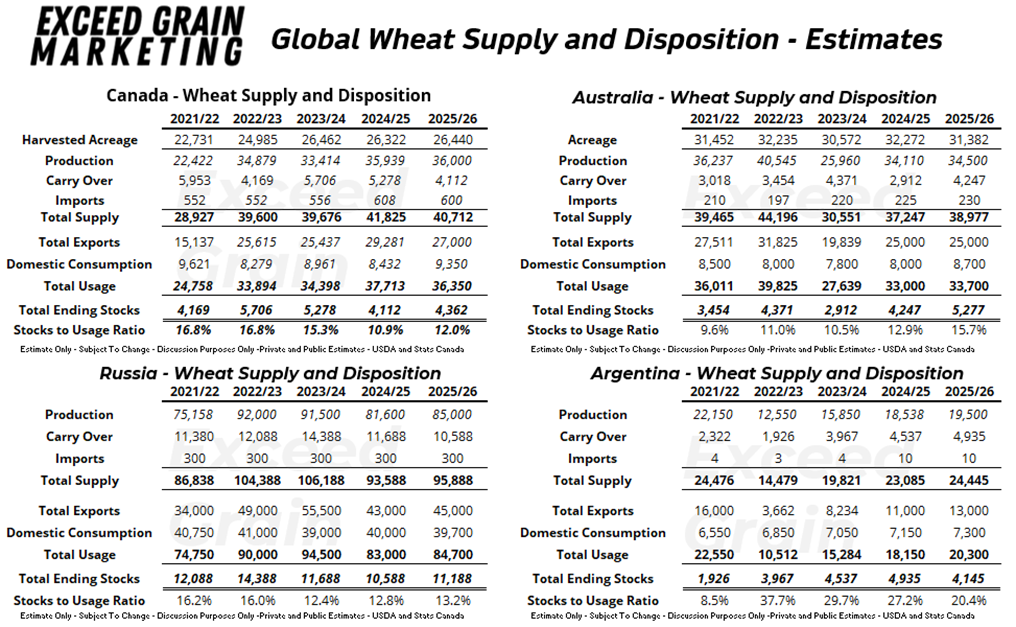

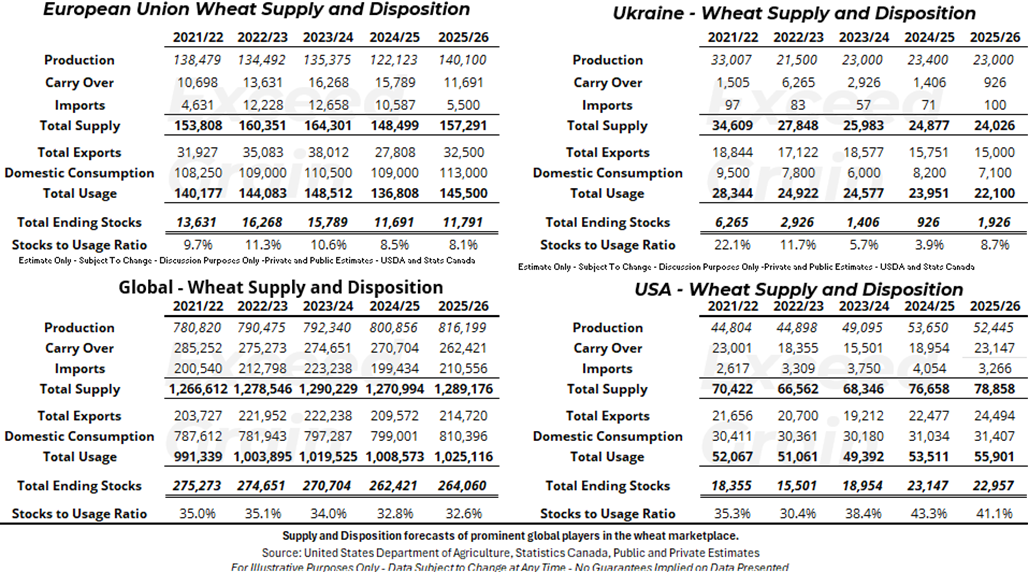

- Global crop size is set to increase 2 per cent year-over-year but on the flip side, consumption is set to rise 2 per cent as well to help offset some of the extra tonnage being harvested in the northern hemisphere and anticipation of larger southern hemisphere crops.

- Imports are expected to increase for the year as Asian and African nations are expected to import more wheat year-over-year. European import demand is expected to damper some of the gains seen in Asia and African regions. Turkey is expected to take around 9 mmt of wheat this year, up from last year’s 4.8 mmt. The 9 mmt is closer to recent historical import volumes although as they took 10 mmt and 13.9 mmt in the two years preceding last year. According to the International Grains Council (IGC), Indonesia is expected to take 11.8 mmt vs 10.7 mmt last year, China, Korea, Philippines are all in for more coverage this year as Pacific Asian nations are expected to snag an extra 3.8 mmt this year vs last.

Canada

- Saskatchewan spring wheat harvest is listed as 73 per cent completed as of Sept. 22, 2025. Durum is 78 per cent harvested. Crop harvest has made significant progress since the September 22 date due to a nice dry stretch of weather. We would expect harvest to wrap up in the coming days for most regions of Saskatchewan for the cereal crops. There was a long weather-related delay near the middle of the month in southern and eastern cropping areas of the province. Durum and spring wheat unharvested during this rainfall has been coming off with lesser quality. Pockets of southeast Saskatchewan took heavy rains of five inches or more in the timeframe and there is reporting of sprouting and severe degradation of wheat left unharvested at the time. We are still trying to solidify the tonnage affected. It is expected that there are enough good quality early harvested wheat quantities that will allow it to be blended out in the supply chain.

- Alberta’s harvest is 89 per cent completed for spring wheat as of Sept. 23, 2025, and that number should touch the fully completed mark here this week. 92 per cent of the durum crop is off. Alberta had a good dry stretch of harvest and is reporting 78 per cent of the spring wheat as #1 vs 58 per cent average, and 18 per cent as a #2 vs 33 per cent average. Durum quality is at 48 per cent #1 vs 58 per cent the year prior, 24 per cent #2 vs 28 per cent, and 13 per cent #3 vs 9 per cent.

- Canadian FOB values ticked lower by $2 per tonne off the west coast for the week but are still in the same trading range seen since mid-August. Canadian wheat sits at about $5 USD per tonne lower off the west coast vs U.S. wheat off the Pacific Northwest.

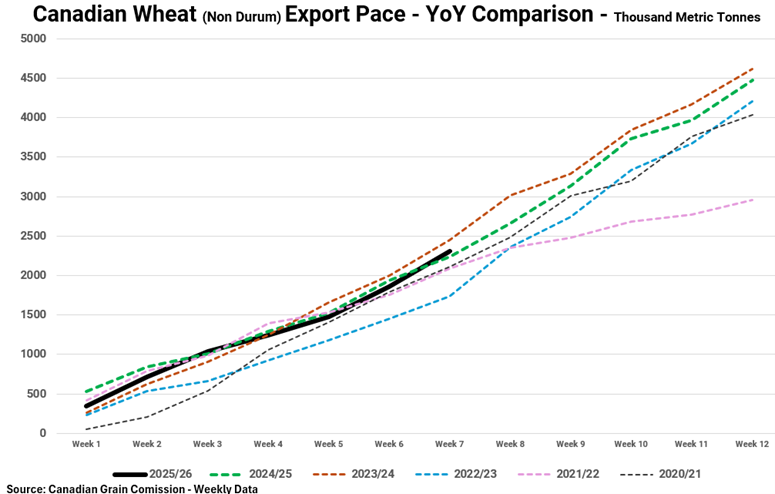

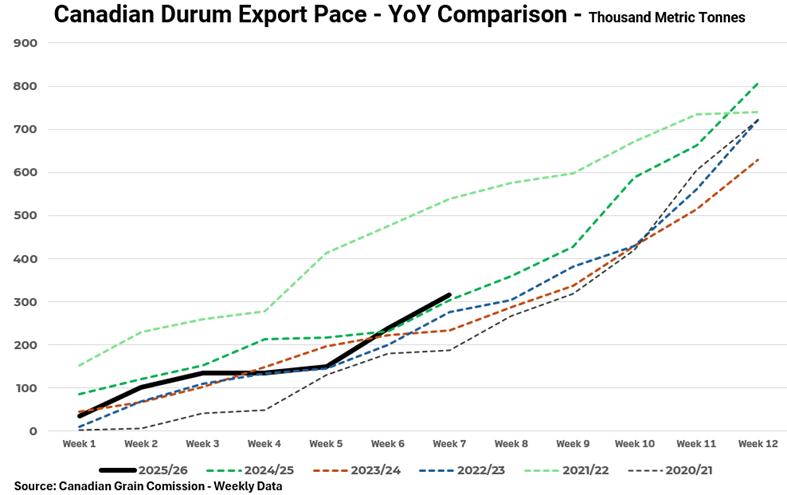

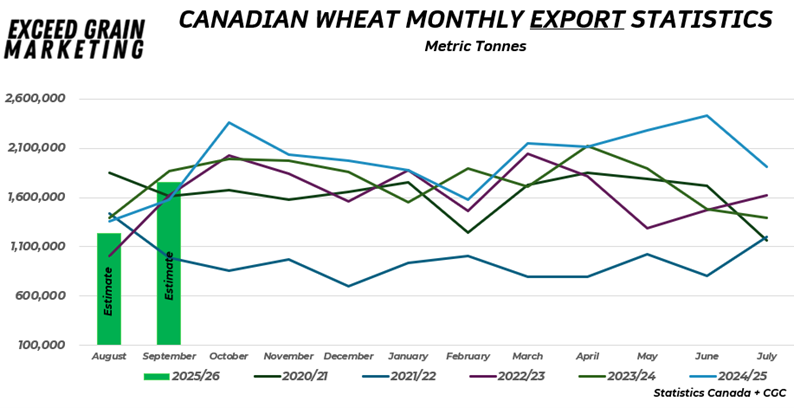

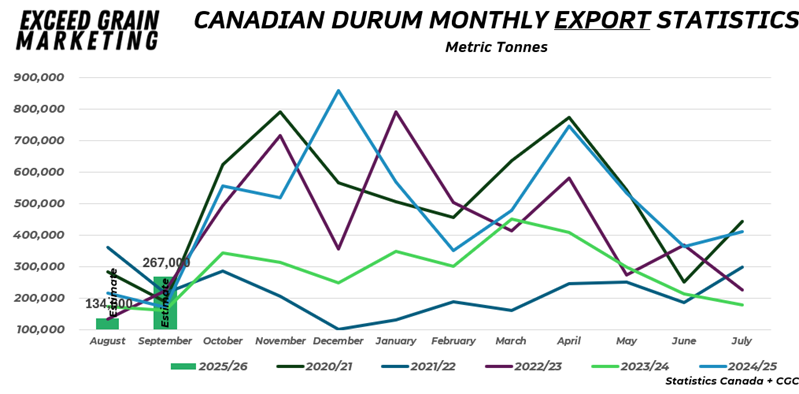

- Canadian durum and wheat exports are moving along at a steady pace. Updated export statistics below. Export facilities are just now nicely being able to see wheat and durum new crop, much of the exports have been completed with old crop supplies remaining in the system.

U.S.

- Wheat export total commitments for the 2025/26 marketing year are up 22 per cent year-over-year citing good demand for the crop. Currently, 13.6 mmt of the U.S. wheat crop are spoken for which is 56 per cent of the USDA’s total anticipated 24.5 mmt of exports for the crop marketing year all together. Actual shipments of wheat sit 16 per cent ahead of last year.

- Mexican commitments of S. wheat are already 23 per cent higher than last year while other major buyers of the crop such as Philippines, Indonesia and Japan have all opted for more crop already.

- United States will release its September 30 Grain Inventories report tomorrow. This will give the market some fundamental data to trade upon depending on how the figures shake out.

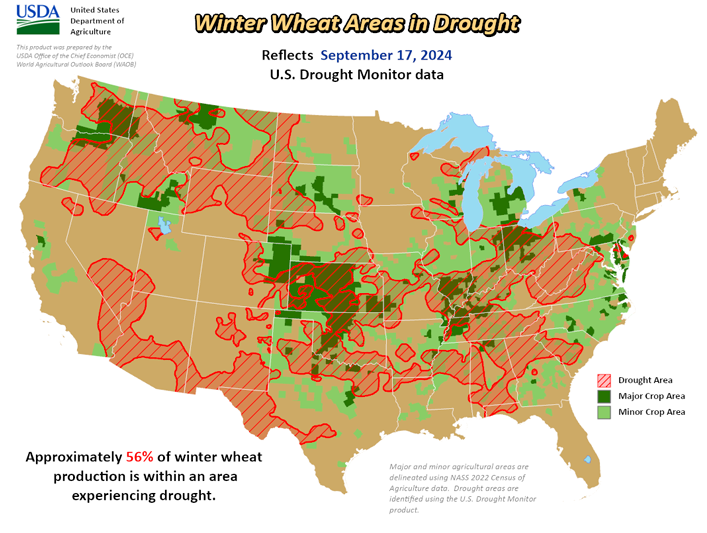

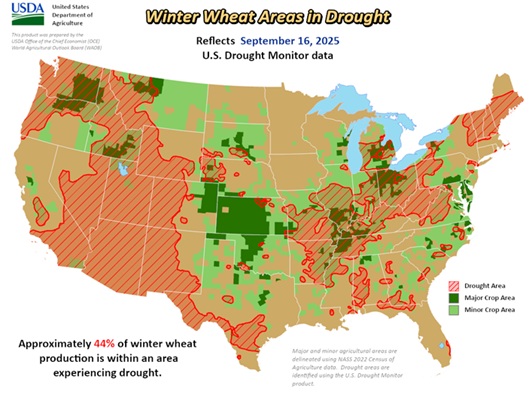

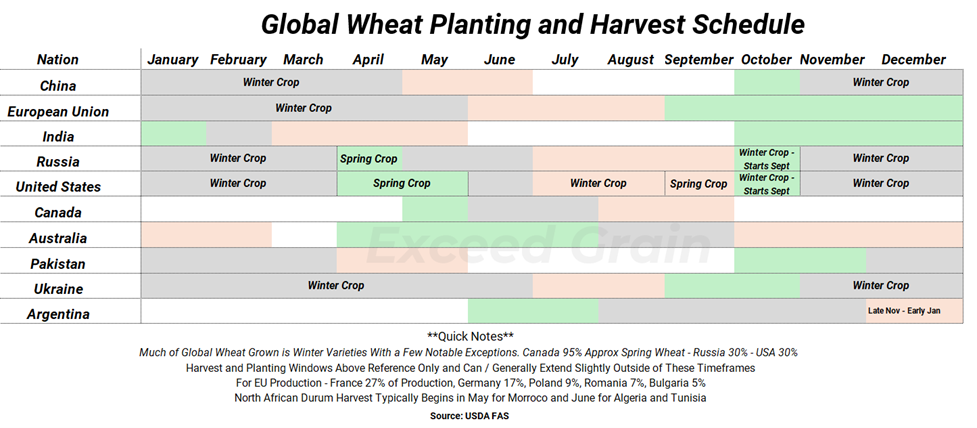

- U.S. winter wheat crop 20 per cent planting is completed as of last week. The crop is headed into the ground in good planting conditions. Drought conditions are less prevalent in the planting regions for U.S. winter wheat. As of mid-September, U.S. winter wheat acres in drought sat at 44 per cent compared to 56 per cent year-over-year. Most of the drought is in the eastern regions in the soft red winter wheat areas. The hard red winter wheat areas of Kansas, Oklahoma, Colorado, Texas and Nebraska are faring mostly better than the same time last year.

Argentina

- Argentina temporarily removed export taxes on wheat and other grains/oilseeds on Sept. 23 and 24. During this timeframe, there were significant purchases of all grains completed by importing nations. Argentina reported upwards of 40 cargos of soybeans sold. For wheat, 682,000 tonnes or about 12 cargos of wheat were anticipated to have been sold. The supply shock did keep global FOB prices in check as Argentina was a go-to source of supplies for the week.

- Argentina’s crop is expected to come in large at 19.5 mmt vs 18.5 mmt last year. Crop ratings from the Buenos Aires Grain Exchange reported at 97 per cent good to excellent for the week ending September 24. This is up from 68 per cent the year prior and good rains have kept prospects high. Some heavy soil moisture in region of Buenos Aires province has increased reports of fungus related diseases. The crop at this point is expected to grow vs shrink.

Russia

- Export taxes are set to rise for the fifth straight week to land at about $8 USD per tonne up from around of $6 USD per tonne last week and no export tax one month ago.

- Russia’s Ministry of Agriculture has reported 2025/26 wheat harvest tonnage in its recent report at 84 million tonnes with some yet to come in. USDA and IGC are both anticipating 85 mmt of total wheat production for the current harvest.

- Russian wheat crop is being forecasted by the IGC at 85 mmt which is higher by 1.3 mmt month-over-month. Although, the gains in Russia may be offset partly by the losses year-over-year in Ukraine. The Ukrainian crop at 25 mmt is set to come in around 10 per cent lower compared to the five-year average.

Turkey

- Turkey MARS has reported due to early drought conditions there are wheat production cuts expected for the 2025/26 wheat production year. Expectations of 19.5 mmt wheat production which would be a 1.3 mmt haircut from the year prior. Of note, Turkey’s 2025/26 durum crop estimated is at 3.7 mmt vs 4.4 mmt from the prior year.

Australia

- Australian crop will hit the market in the coming months as the north heads into winter, crops look great and there is 34.5 mmt of production vs 34.1 mmt last year.

EU/Black Sea

- We will see European/Black Sea winter wheat planting progress more prominently in October as producers get the crop in before winter. Acreage estimates for winter wheat globally still questioned. There is chatter of flat to a few per cent lower winter wheat acres being planted in the United States for the upcoming campaign. Producers will mostly stick to rotation and planting conditions are conducive to germinating a crop. Reports of dry southern and central regions of Russia will keep winter wheat planting delayed while northern European Union has benefited from some later rainfall.

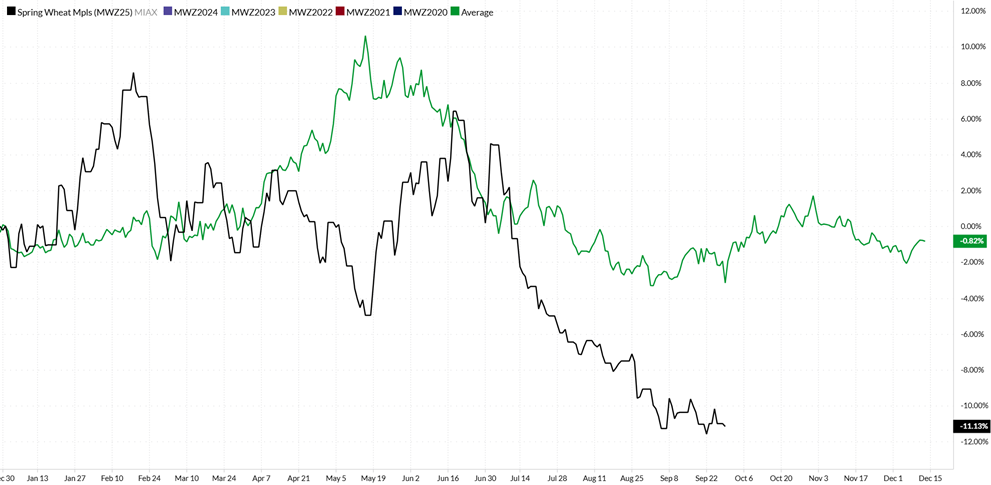

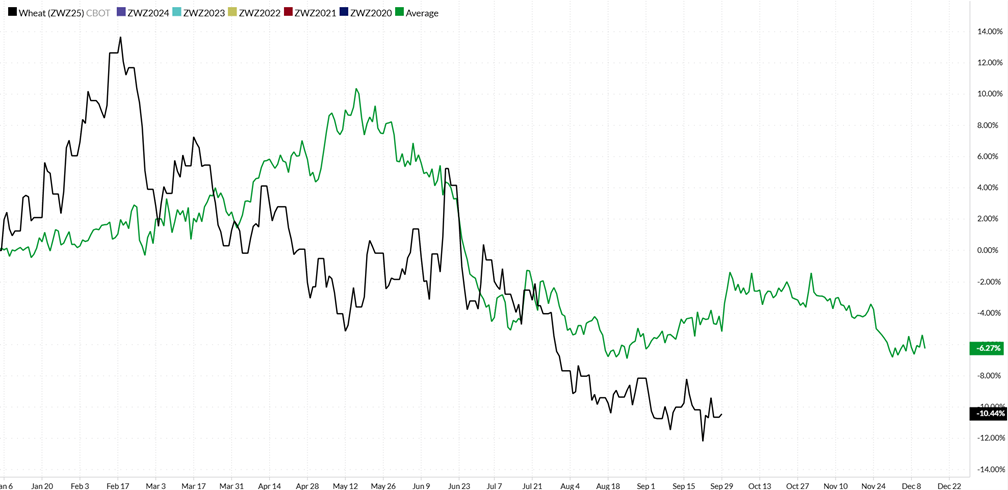

Market Outlook – Wheat

Wheat futures markets remain at levels not seen in around five years. New contract lows were made once again for both European and North American futures. Wheat markets have been digesting the larger crop sentiment for about a month now and there is a good understanding that the Australian and Argentinian crops will be of good quality. We have seen a stabilizing and even a slight increase in some cases in global wheat bids from export locations and there is the rolling idea that although many key regions are behind on exports, we know that import demand is forecasted to come to the market by many key agencies. Algeria’s large-scale purchase of 600,000 tonnes and some other more business being completed at these levels has importers beginning to see the value of the crop available to them. This reinforces that the market is of the notion that although global crop sizes have increased, global demand is still there. We remain hesitant to make major sales at the current time amidst harvest pressure and typical seasonality of markets.

Market Outlook – Durum

Canadian crop size has been increasing as producers get into harvest with Statistics Canada estimating the crop at 6.5 mmt up from 6.1 mmt in the August estimate. The crop size is larger than last year’s total volume. Global import demand is expected to drop from 9.2 mmt last year to 8.6 mmt this year, larger global production being penciled in at 37.2 mmt vs last year’s 36.4 mmt of which Canada will account for 6.5 mmt of that. EU crop is at 8.3 mmt vs 7.2 mmt last year. Ending stocks this year are expected globally at 7.5 mmt vs 6.7 mmt last year and Canadian durum will need to be competitive. Early exports of Canadian durum have been strong and pricing well into EU and North Africa. We are watching this trend closely and keeping an eye on export shipments in a proactive manner to analyse the movements.

CASH MARKETS

Markets are looking for a demand story as many key exporting nations exports are behind pace. There are reports of buyers waiting on the sidelines as demand needs are not immediate and can afford to play out the markets for the time being. Major news at this point likely to come from demand as market understands supply side already. Algeria’s large purchase of 600,000 tonnes is notable for Oct/Nov shipment and shows demand is nearby.

GLOBAL PURCHASES AND TENDERS

- Algeria purchased 600,000 tonnes of wheat mid last week. The large-scale purchase was completed in the $259 and $261 per tonne c&f range. The purchase is expected to be of mostly Black Sea origin and will be shipped Oct/Nov.

- Jordan secured 60,000 tonnes of milling wheat for November shipment at $266 per tonne c&f.

- South Korea purchased 25,000 tonnes of U.S. DNS wheat split up between Nov/Dec and Dec/Jan for $259 and $260 per tonne FOB.

FUTURES MARKETS

Futures continue to carve out their lows and find themselves near the bottom end of their 52-week trading range. Harvest pressure and lack of bullish fundamental stories keeping market trends unchanged.

Seasonal Charts – Minneapolis Spring Wheat – Average (Green Line) Current Year (Black Line)

Seasonal Charts – Chicago Wheat – Average (Green Line) Current Year (Black Line)

United States Winter Wheat Regions in Drought – Year-Over-Year