Wheat Market Outlook and Prices

The Wheat Market Outlook is provided by Exceed Grain Marketing.

Wheat Market Outlook – October 6, 2025

Western Canadian Markets Highlights / Key Events

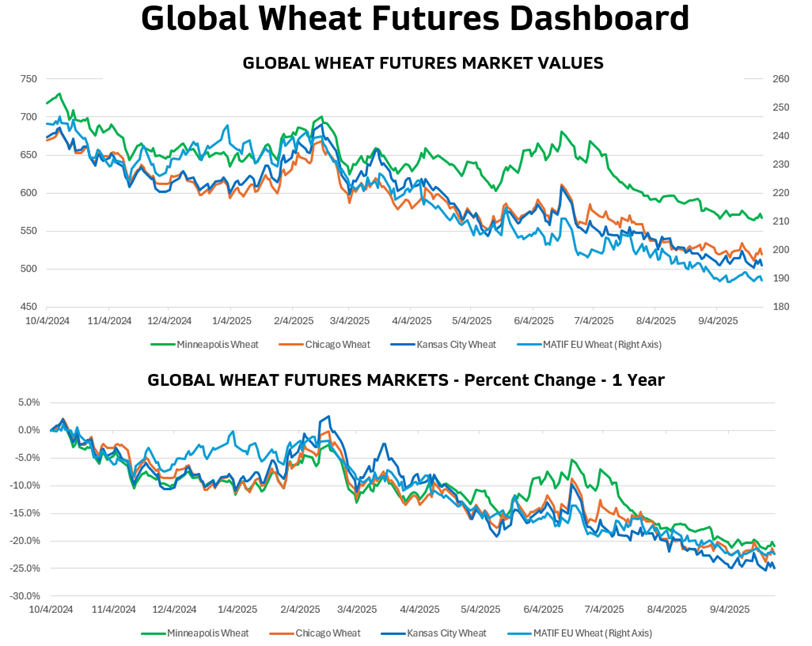

WHEAT FUTURES

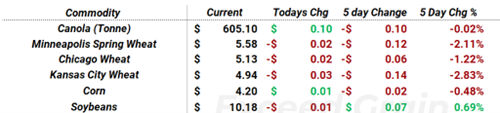

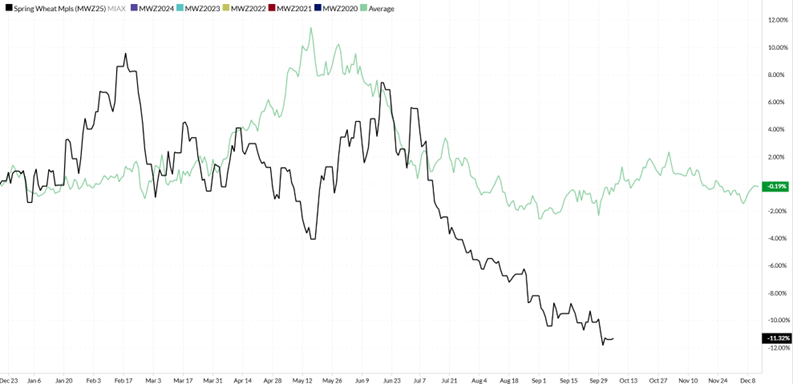

Minneapolis Spring Wheat

- Futures sit at $5.58 per bushel on the U.S. based contract. New contract lows were made last week at $5.55 per bushel Oct. 2, 2025.

Kansas City Wheat

- $4.94 per bushel this morning. KC wheat sits above its contract low of $4.88 per bushel set on October 1st.

Chicago Wheat

- Chicago wheat sits at $5.13 per bushel. New contract low of $5.02 set on October 1st.

European Wheat

- MATIF wheat futures at 187.75 euro per tonne. New contract low set at 185.00 euro per tonne on October 1st.

Global Wheat Market Notable Items

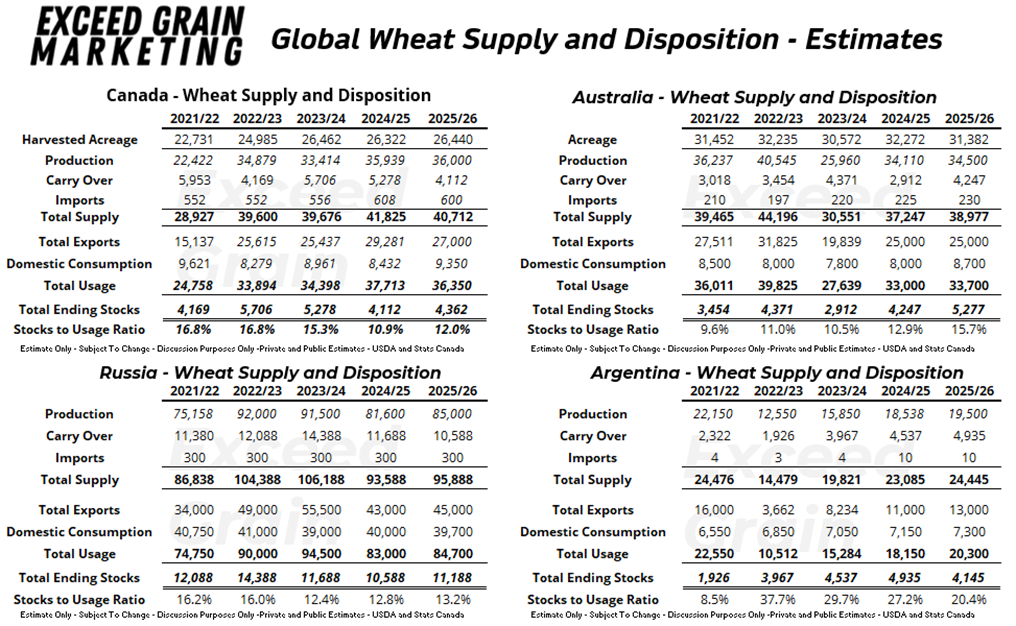

Canada

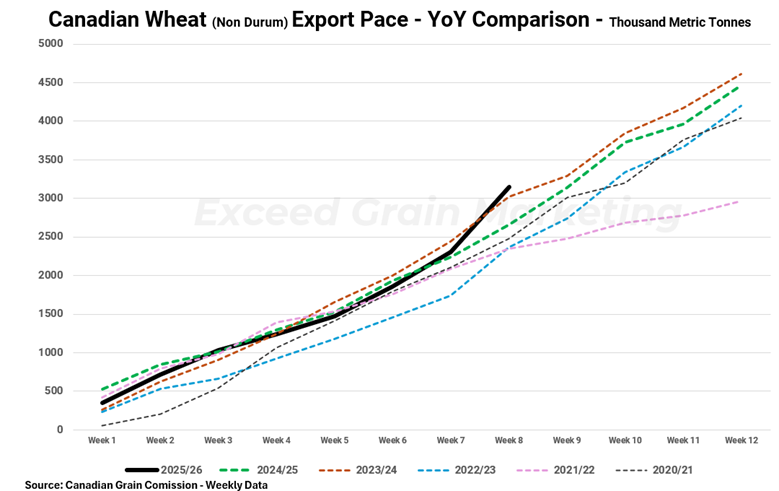

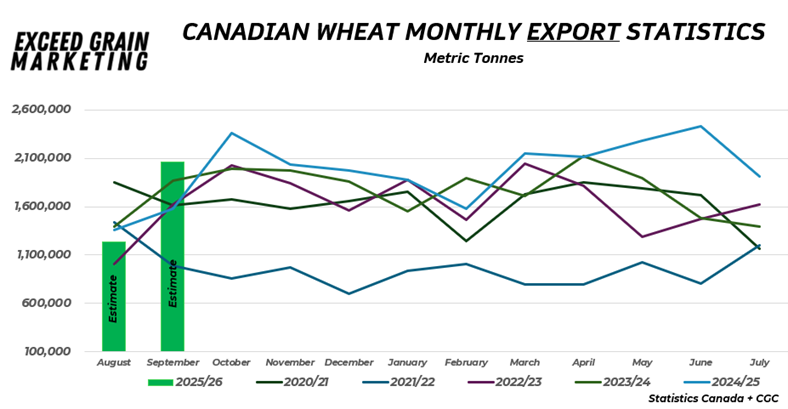

- Canadian wheat exports posted a very strong week 8 of export shipments. 841,000 tonnes of wheat were exported for week 8 as the new crop hits the ports. Canadian wheat exports sit at 3.15 mmt for the crop marketing year which is ahead of the 2.68 mmt of exports for the same time last year. Last years’ record pace is already being surpassed and with the stocks and ships in port we can expect a relatively strong pace for the current week as well.

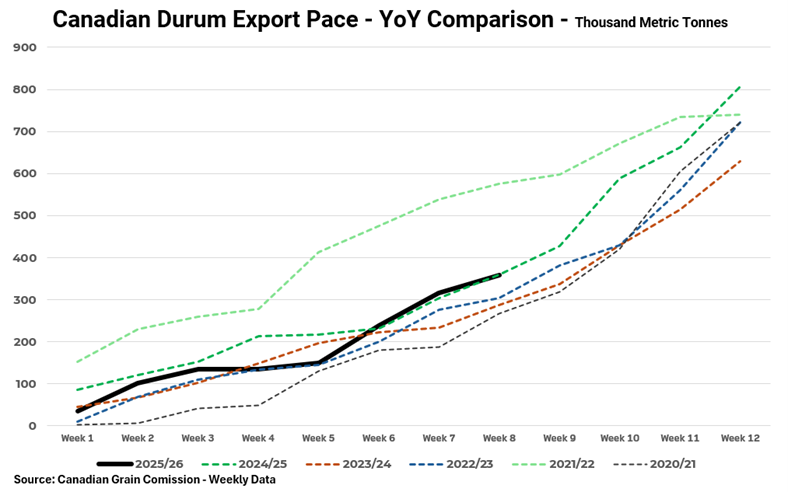

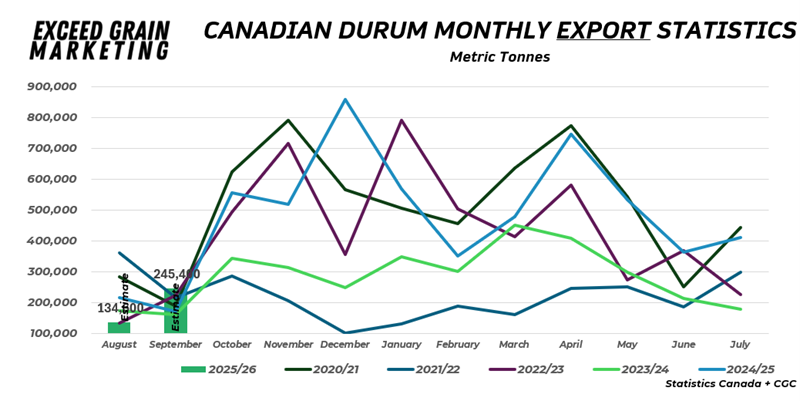

- Canadian wheat demand is strong and seeing rapid movement, with local delivery points prioritizing the movement of wheat in recent weeks to meet demand at port facilities. Canadian Durum exports sit at 359,000 tonnes of movement as of week 8 and right in line with last year’s pace.

- Canadian crop harvest mostly completed.

- Saskatchewan harvest is 84 per cent completed as of Sept. 29, 2025. 90 per cent of the durum is harvested and 92 per cent of the spring wheat is off the field.

- Alberta 89 per cent of their harvest is off and in the bin. 96 per cent of the spring wheat is harvested.

- Manitoba reporting 98 per cent of their spring wheat harvested.

- Quality of the Canadian wheat crop (Data as of Sept. 25, 2025, from the CGC):

- Durum: 41 per cent of samples graded #3, 25 per cent graded #2 and 18 per cent graded #1. Protein content across all graded averaged 14.9 per cent of the 190 samples in their system at the Canadian Grain Commission (CGC).

- 2024 Durum was 73 per cent in the #1 or #2 categories vs 43 per cent so far this year.

- Durum protein content was 15.3 per cent

- Red Spring Wheat: 81 per cent of samples graded #1, 17 per cent graded #2, 1 per cent #3 and 2 per cent feed. Protein content across all 512 samples took in by September 25th was 13.8 per cent. Last year the average protein content was 14 per cent. Last year 67 per cent was a #1CWRS, 27 per cent #2 CWRS and 6 per cent in #3 or feed categories

- 89 per cent of CWRS samples had a falling number above 351 seconds, the same figure as 2024 when 89 per cent was reported as well.

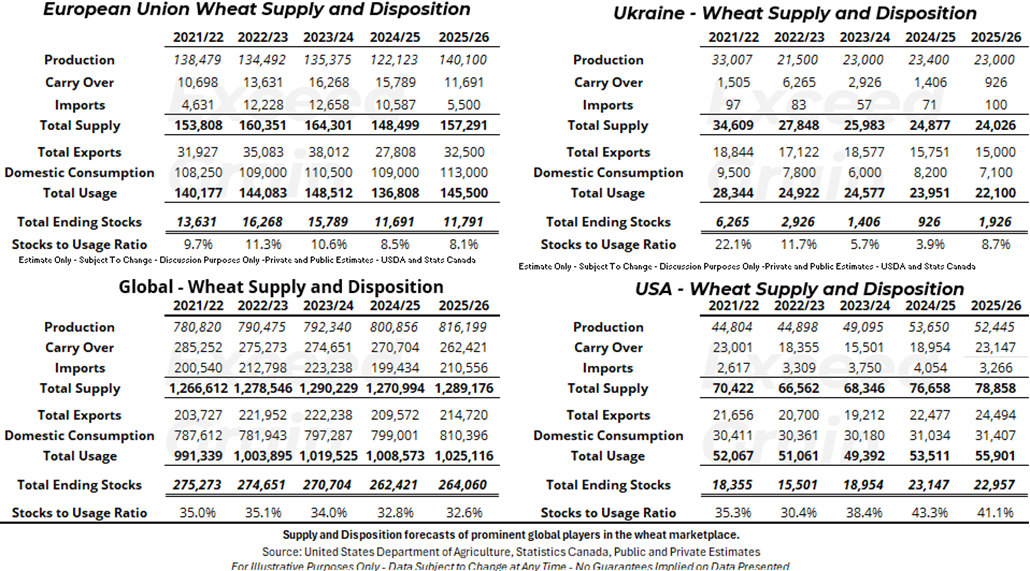

U.S.

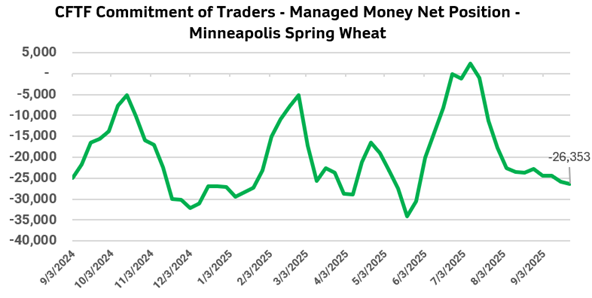

- United States government shutdown is currently in effect. Due to this, there is a funding lapse at certain government departments. As a result, there is no monthly WASDE or FAS reports expected for Oct. 9, 2025. The market will be working without their fundamental data sets for the month of October. The market is also missing a few key reports that they expect from USDA government agencies such as the weekly harvest progress data, export sale data and commitment of traders reports from the CFTC.

- U.S. wheat export sales were quite large heading into the government shutdown, and we know that there has been some key business still being completed recently in the cash markets. U.S. exporters sold wheat to Taiwan Flour Millers Association for a reported 80,550 mt of milling wheat. The shipment will be made up of Dark Northern Spring (DNS)14.5 per cent at $277.55 to $288.05 fob, Hard Red Winter (HRW) 12.5 per cent at 242.04 to $248.04 and soft wheat at $231.05 to $234.05 per tonne for November/Dec shipment.

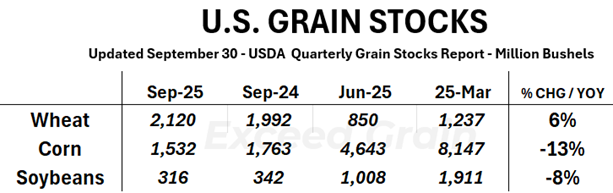

- U.S. stocks report was released Sept. 30, 2025, prior to the government shutdown. Wheat ending stocks were raised 6 per cent year-over-year. Corn and soybean stocks were lower year-over-year.

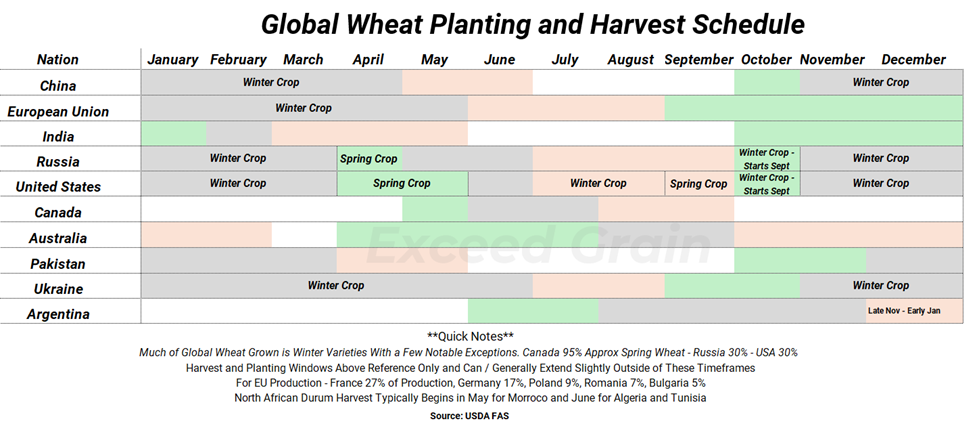

Black Sea

- Winter wheat planting is progressing. Russia is reporting around 54 per cent of the winter wheat crop has been planted on anticipated acreage.

- Ukraine has about 30 per cent planted.

- The news for this region will turn to weather and the crops health as we turn into northern hemisphere winter. The southern region of Rostov is still considered to have drought conditions. Dry regions exist in the Black Sea production area, but markets will watch how this crop shapes up heading into dormancy.

- Turkey MARS has reported that due to early drought conditions there are wheat production cuts expected for the 2025/26 wheat production year. Expectations of 19.5 mmt wheat production would be a 1.3 mmt haircut from the year prior. Of note, Turkey’s 2025/26 durum crop is estimated at 3.7 mmt vs 4.4 mmt last year.

- Russian export taxes this week sit at $7.40 USD vs $8.00 USD last week.

Argentina

- Buenos Aires Grain Exchange is reporting 93 per cent of the crop as Good to Excellent, up from last year’s 67 per cent.

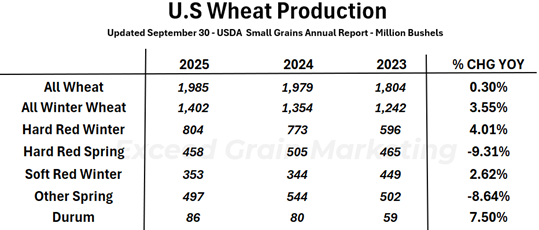

The Wheat Production Report was also featured on Sept. 30, 2025. All wheat production was up, and durum tonnage was up 7.5 per cent year over year. Hard Red Spring Wheat is down 9 per cent while winter wheat classes rose in production.

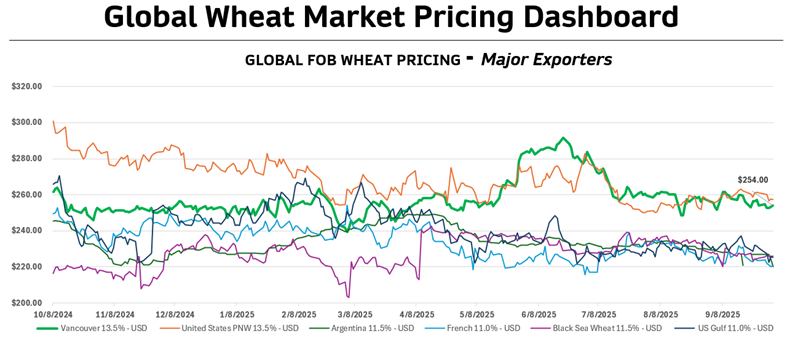

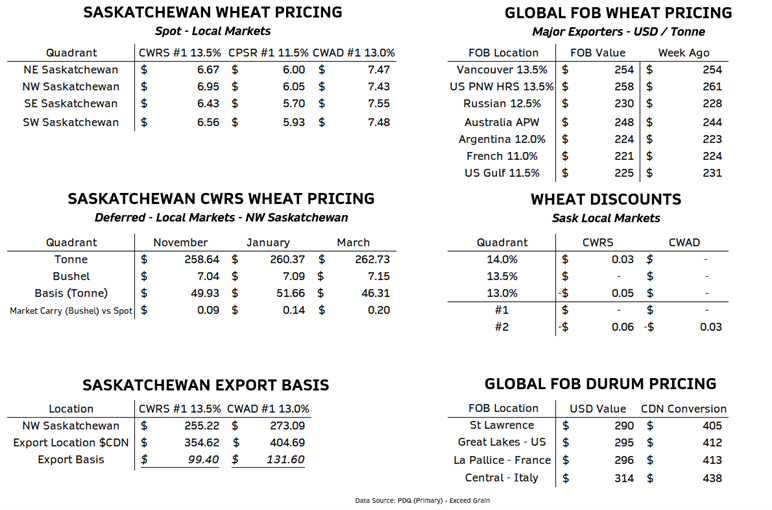

Market Outlook – Wheat

Wheat futures markets remain at levels not seen in around five years. New contract lows were made once again in European and North American futures. Wheat markets have been digesting the larger crop sentiment for about six weeks now and there is a good understanding that the Australian and Argentinian crops will be of good quality and quantity. We have seen a stabilizing, and even a slight increase in some cases, in global wheat bids from export locations and there is the rolling idea that although many key regions are behind on exports, we know that import demand is forecasted to come to the market by many key agencies. Although global crop sizes have increased, global demand is still there. There are some key regions behind export pace particularly in the Black Sea / European regions while North American pace appears strong. We remain hesitant to make major sales at the current time amidst later stages of harvest pressure and typical seasonality of markets.

Market Outlook – Durum

Canadian crop size has been increasing as producers wrap up harvest with Statistics Canada estimating the crop at 6.5 mmt up from 6.1 mmt in the August estimate. The crop size is larger than last year’s total volume. Global import demand is expected to drop from 9.2 mmt last year to 8.6 mmt this year, larger global production being penciled in at 37.2 mmt vs last year’s 36.4 mmt of which Canada will account for 6.5 mmt of that. EU crop at 8.3 mmt vs 7.2 mmt last year. Ending stocks, this year are expected globally at 7.5 mmt vs 6.7 mmt last year and Canadian durum will need to be competitive. Early exports of Canadian durum have been strong and are pricing well into EU and North Africa. We are watching this trend closely and keeping an eye on export shipments in a proactive manner to analyse the movements.

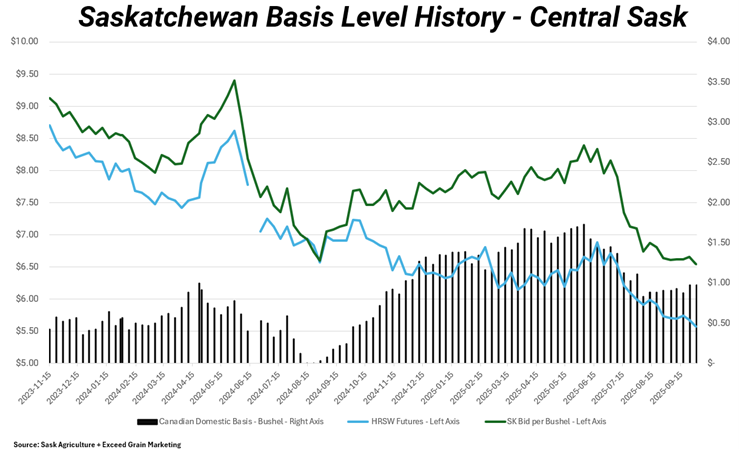

CASH MARKETS

Markets looking for a demand story as many key exporting nations exports are behind pace. Reports of buyers awaiting on the sidelines as demand needs are not immediate and can afford to play out the markets for the time being. Major news at this point likely to come from demand as market understands supply side already. Cash markets mixed but in general steadier in recent weeks as futures markets continue to struggle to find any true support.

GLOBAL PURCHASES AND TENDERS

- Saudi Arabia purchased 455,000 tonnes of wheat for December and January shipment. The average cost is reported at 263.38 per tonne cost and freight. Optional origin but expected to be mostly of Russian / Black Sea wheat. 12.5 per cent protein milling wheat.

- Taiwan Flour Millers Association purchased a reported 80,550 mt of milling wheat. U.S. origin. Shipment made up of DNS 14.5 per cent at $277.55 to $288.05 fob. Hard Red Winter 12.5 per cent at 242.04 to $248.04 and soft wheat at $231.05 to $234.05 per tonne. November/Dec shipment.

- Jordan cancelled its 120,000 tonne tender this past week due Sept. 30, 2025. Expecting to retender this week.

- Late September, Jordan secured 60,000 tonnes of milling wheat for November shipment at $266 per tonne c&f.

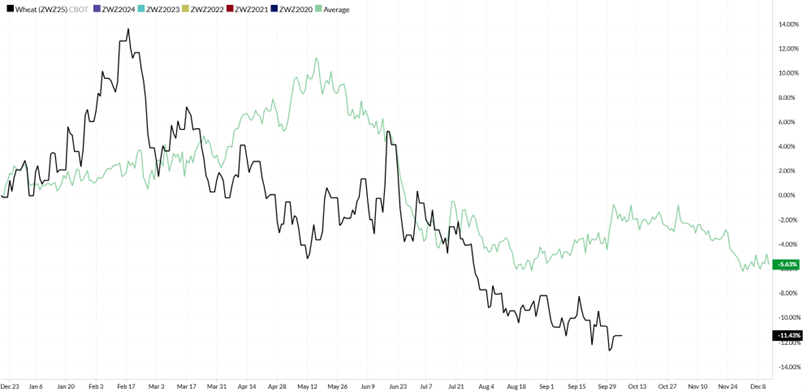

FUTURES MARKETS

Futures continue to carve out their lows and find themselves near the bottom end of their 52-week trading range. Harvest pressure and lack of bullish fundamental stories are keeping market trends unchanged.

Seasonal Charts – Minneapolis Spring Wheat – Average (Green Line) Current Year (Black Line)

Seasonal Charts – Chicago Wheat – Average (Green Line) Current Year (Black Line)