Wheat Market Outlook and Prices

The Wheat Market Outlook is provided by Exceed Grain Marketing.

Wheat Market Outlook – October 14, 2025

Western Canadian Markets Highlights / Key Events

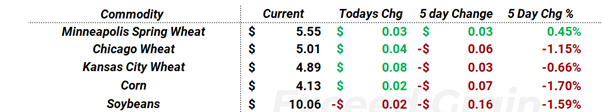

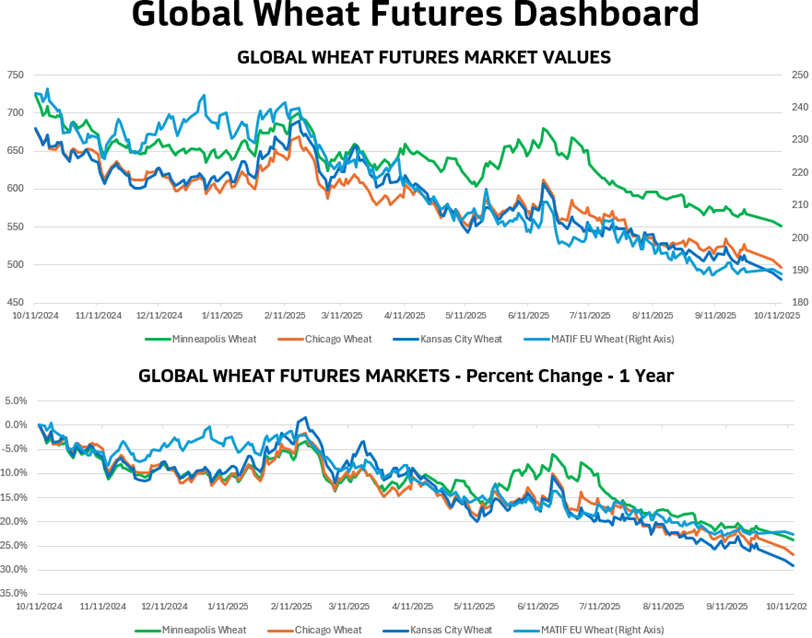

WHEAT FUTURES

Minneapolis Spring Wheat

- Futures sit at $5.55 per bushel on the U.S. based contract. New contract lows were made this morning at $5.50 on the December contract. In the past 15 weeks, Minneapolis wheat has only traded higher for the week twice.

Kansas City Wheat

- $4.89 per bushel this morning. KC wheat sits above its contract low of $4.77 per bushel set this morning, Oct. 14, 2025.

Chicago Wheat

- Chicago wheat sits at $5.01 per bushel. New contract low of $4.92 set on Oct. 14, 2025.

European Wheat

- The bright spot of wheat futures, MATIF wheat futures at 190.50 euro per tonne. New contract low set at 185.00 euro per tonne on Oct. 1, 2025, and showing a slight weekly gain so far at 1.50 euro per tonne.

Global Wheat Market Notable Items

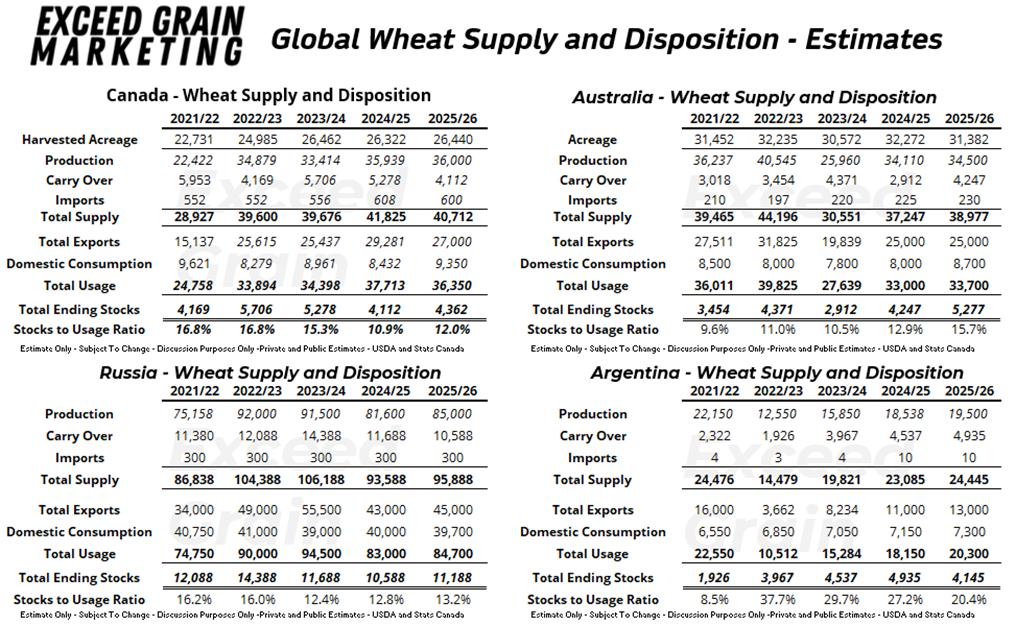

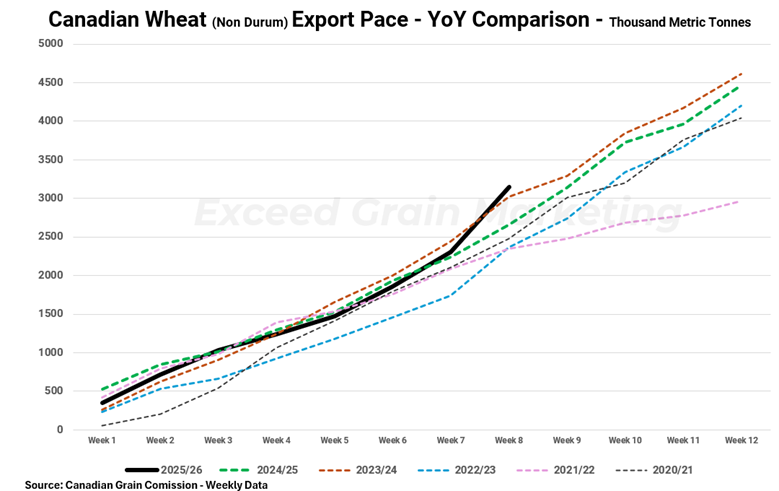

Canada

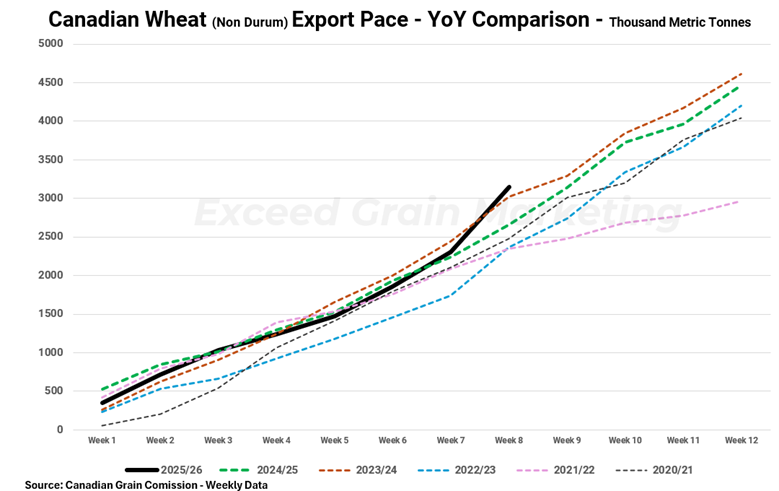

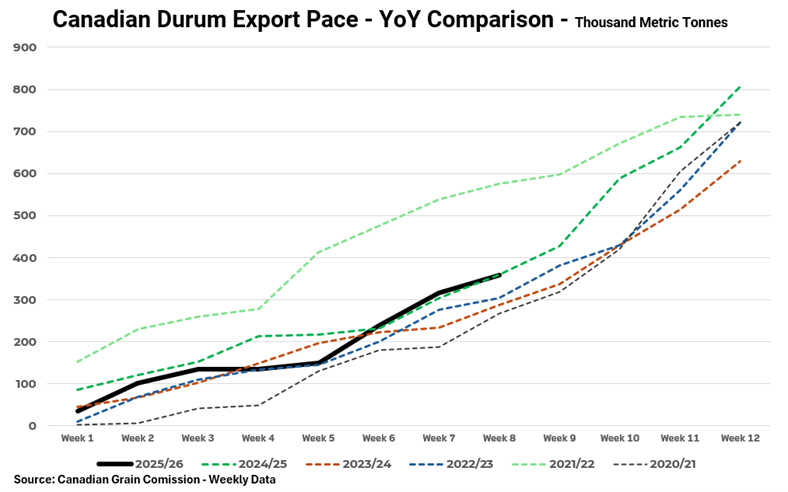

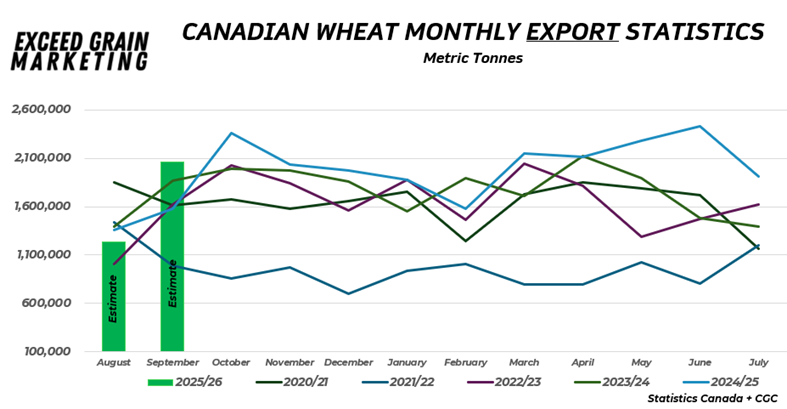

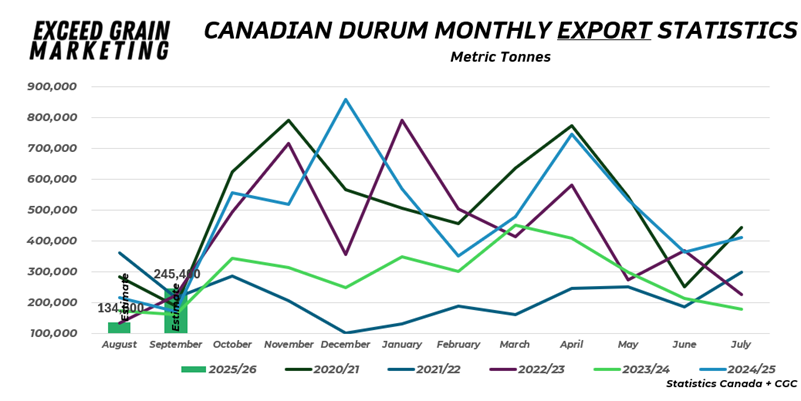

- Wheat demand is strong once again this week as Canadian wheat exports come in at 421,000 tonnes and durum exports in at 108,000 tonnes. This pushes both classes of wheat above last year’s rapid pace and healthy port stocks of both keep exportable product ready to ship. Current year non-durum wheat exports sit at 3.6 mmt vs 3.2 mmt last year cumulative. Durum exports sit at 467,000 tonnes cumulative vs 431,000 tonnes last year. Producer deliveries into CGC registered locations are strong as well citing good harvest and movement availability during harvest and now post-harvest. Non-durum wheat producer deliveries into the system equate to 4.61 mmt vs last year’s 4.37 mmt. For durum, the number sits at 1.06 mmt vs 0.76 mmt last year.

- Crop harvest is all but wrapped up. Saskatchewan’s spring wheat crop is 98 per cent harvested as of Oct. 6, 2025, and 96 per cent of the durum. Manitoba and Alberta reporting wheat harvest in general is wrapped up.

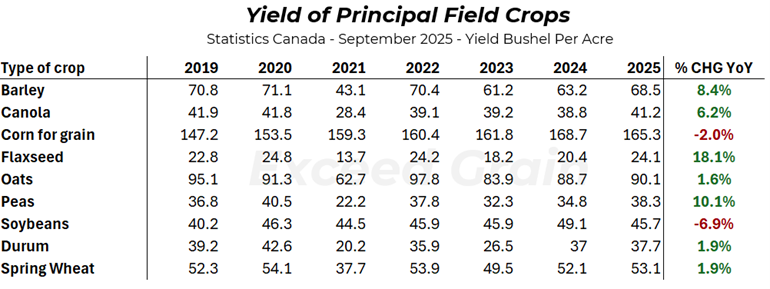

- Saskatchewan Ministry of Agriculture Oct. 6, 2025 Crop Report presented some updated yield figures from their crop reporters. Provincial crop reporters pegging the CWRS crop at 51 bushels per acre (bpa) and durum at 41 bpa. Growth from one month ago when on Sept. 8, 2025, the CWRS crop was reported at 50 bpa and durum at 38 bpa. Oct. 21, 2024, yield in the final provincial crop report for the year was at 46 bpa for CWRS and 33 bpa for durum.

- Alberta reporting 56 bpa as their provincial average for spring wheat as of Oct. 7, 2025. 45 bpa was the provincial average estimate last year.

- Quality (Data as of Oct. 6, 2025 CGC):

- Durum

- Protein – 2025 protein content at 14.8 per cent vs 15.3 per cent last year (December Final Report) (All Grades)

- Grade – 48 per cent of samples graded either #1 or #2 CWAD in 2025 vs 73 per cent last year (December Final Report) while 37.5 per cent of the durum in 2025 fell in the #3 category vs just 12.5 per cent last year. More precipitation during harvest being left to blame. Severely sprouted kernels, midge damage, mildew, Fusarium and weight being major factors putting more into the #3 category this year vs last. Last year it was almost exclusively weight being the factor for #3 durum.

- Canadian Western Red Spring Wheat

- Protein –2025 Protein Content at 13.8 per cent vs 14.1 per cent last year. (December Final Report) (All Grades)

- Grade – 98 per cent of wheat grading #1 or #2 CWRS vs 94 per cent last year. The factors pushing the slight amount below the #2 grade include Fusarium and sprouting although overall the CWRS from the samples took in until the October 6 report date were mostly good quality.

- Durum

Black Sea

- Russia export taxes this week sit at $6.00 USD per tonne vs $7.40 USD last week.

- Ukrainian wheat exports are at a cumulative 4.8 mmt which is down 26 per cent year-over-year with the slower pace holding steady. One month ago on September 12 it was reported that Ukrainian wheat exports were at a 27 per cent slower pace year-over-year. Exports need to play catchup, and markets are starting to see some renewed demand with some larger sales coming into the system. It’s not just wheat with slower year over year exports out of Ukraine, total grain exports out of Ukraine for the marketing year sit at 6.7 mmt total which is 40 per cent behind last year’s pace.

- Russian wheat exports for October are expected to come in at 5.1 mmt which would be down from 6.1 mmt from October of last year but ahead of the 4.8 mmt five-year average.

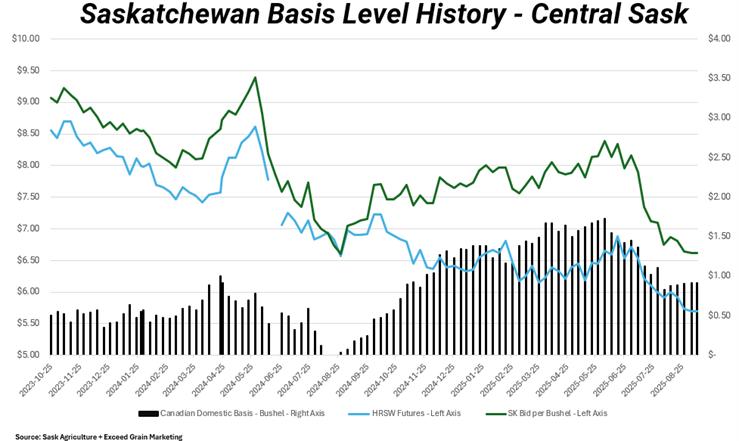

- Russian wheat plantings for 2026/27 are expected by their ministry of agriculture to be lower year-over-year. The Russian Ministry of Agriculture has winter wheat and spring wheat total acres about 6 per cent lower as they favour oilseeds such as rapeseed, sunflowers and soybeans. The oilseed area is expected to grow by 9 per cent. As of early October, Russia is reporting around 54 per cent of the winter wheat crop has been planted on anticipated acreage. Ukraine has about 30 per cent planted. The news for this region will turn to weather and the crops health as we turn into northern hemisphere winter. The southern region of Rostov is still considered to have drought conditions. Dry regions exist in the Black Sea production area, but markets will watch how this crop shapes up heading into dormancy.

- Turkey MARS has reported due to early drought conditions there are wheat production cuts expected for the 2025/26 wheat production year. Expectations of 19.5 mmt wheat production which would be a 1.3 mmt haircut from the year prior. Of note, Turkey’s 2025/26 durum crop estimated at 3.7 mmt vs 4.4 mmt prior year.

Argentina

- Buenos Aires Grain Exchange reporting 93 per cent of the crop as good to excellent. Up from last year’s 67 per cent.

- Rosario Grain Exchange reporting 2025/26 wheat production at 23.0 mmt which is 3 mmt higher than their prior estimate. 18.5 mmt was the number from the local ag ministry the year prior. Argentinian wheat production has been reported good all year with some instances of excess rains and fungal diseases present, the outlook has been good since planting. The crop is looking best in the Buenos Aires province. Producers in the nation according to the Ag Ministry have forward sold about 3.6 mmt of crop for the upcoming harvest or around 16 per cent of the upcoming anticipated harvest.

Morocco

- Wheat imports from the June to September period were reported at 3.9 mmt which is 7 per cent less year-over-year. Common wheat imports were 1.5 mmt which is down 12 per cent year-over-year but durum imports increased 74 per cent to land at 390,000 tonnes. Feed wheat was 81 per cent higher and corn imports were 10 per cent higher.

European Union

- Wheat exports sit at 6.3 mmt cumulative which is down 10 per cent year-over-year.

Egypt

- Wheat imports are down for the 2025 year so far by 34 per cent for a total of 8.2 mmt. According to local customs data 56 per cent of the wheat imports coming from Russia and 31 per cent from Ukraine for a total of 87 per cent market share into the nation. When looking at USDA data, the agency is expecting 2025/26 total Egyptian wheat imports at 13 mmt vs 12.4 mmt for 2024/25, showing some growth expectations in the nations import requirements.

Saudi Arabia

- Was in for a large sum of wheat last week. 420,000 tonnes of milling wheat was sought for the nation and Russia will be the main exporter along with some other Black Sea origin. The wheat requested is 12.5 per cent protein and was bid at $263.38 c&f for December/January arrival.

Tunisia

- Tendering for 100,000 mt of milling wheat for November and December shipment.

Jordan

- Expected to tender for 120,000 mt of milling wheat today, October 14.

Bangladesh

- Purchased 220,000 metric tonnes of U.S. wheat for a reported $308 per tonne this past week. The news comes after the two nations signed a memorandum of understanding (MOU) to import 700,000 tonnes of wheat annually from the United States over the next five years. The MOU and purchase was seen as a way to ease trade tensions. Bangladesh generally relies on lower cost wheat from Black Sea regions and takes in volumes of higher grade North American grains to blend to their requirements. Bangladesh is generally a significant buyer of Canadian wheat and ranges from Canada’s 4 to 6 largest buyer of wheat on any given year typically behind China, Indonesia, Peru, Japan and Columbia. Canadian exporters will be looking to keep their market share into the mature markets they have secured in recent years. Bangladesh, outside of the 2021/22 marketing year due to drought, has been a buyer of around 1.37 million tonnes of wheat from Canada. Canada supplies, on average, about 20 per cent of Bangladesh wheat imports.

U.S.

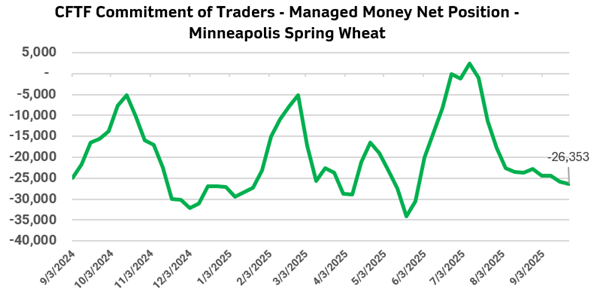

- Government shutdown is entering day 14. For agriculture markets this has resulted in no October USDA, WASDE or FAS reports. There are also no export sales reports from the United States, weekly export data, weekly harvest (crop progress) reports or CFTC futures commitment of trader’s reports leaving the market with less fundamental data to trade upon.

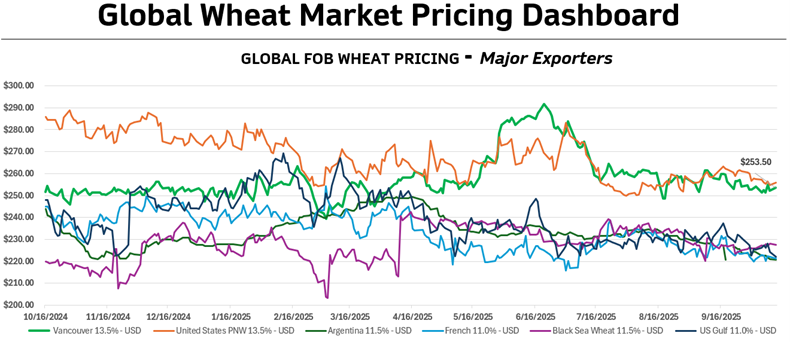

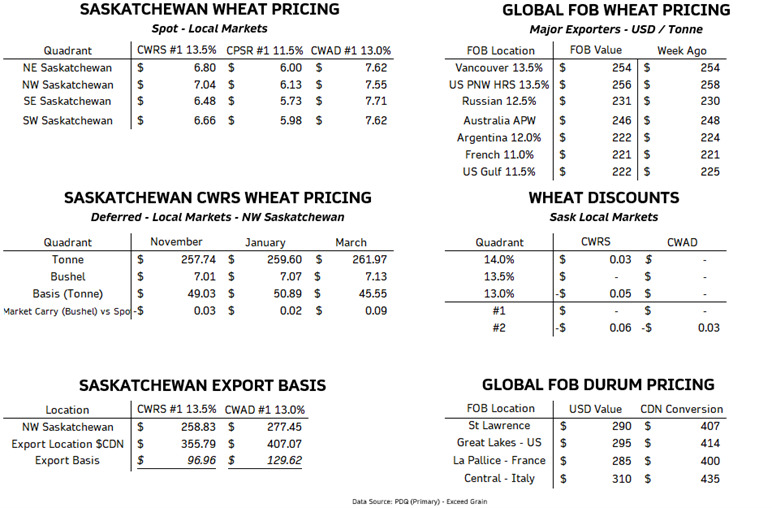

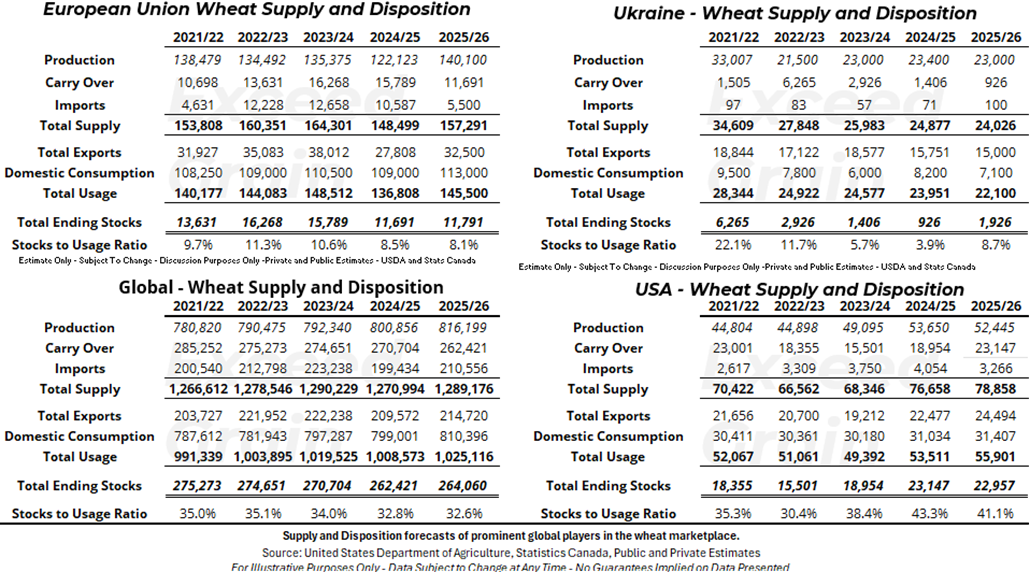

Market Outlook – Wheat

Wheat futures markets still hover near their five-year lows and futures on the front month Minneapolis contract sit at $5.52 per bushel. The last time wheat futures were at this level was December of 2020. Wheat markets continue to be fed new rhetoric towards larger crops and the recent upgrades to Argentinian wheat production levels and anticipation that the Australian crop could grow vs shrink in size has wheat markets resistant to make a move higher. The market will need to make its moves higher on demand related stories. North American demand is perceived as just fine with both U.S. demand forecasted to be strong and Canadian export pace being rapid. European and Black Sea shipping pace is behind pace, and we will need to see true demand pick up out of the region. There are a few key importers behind pace on imports, and we need to see these importers step up to the plate to keep demand moving forwards. Global wheat bids are relatively stable, some few dollar moves in FOB values each week but relatively stable. We will move out of harvest pressure in the northern hemisphere and transition into winter exporting season. Producer bids for spring wheat in the Canadian prairies sit just below $7.00 and we are still on hold for making big sales as we hover and trod along our five-year lows. Strong demand for CWRS is anticipated throughout the winter, we will be watching if U.S. trade deals or MOUs with nations such as Bangladesh on wheat pull from Canadian demand. As we head into winter another item to watch will be any drought or issues with either the European, Black Sea or U.S. winter wheat crops. Russia has some severe drought in the Rostov region, and any weather stories typically are reflected quickly in the market if notable tonnage is at risk.

Market Outlook – Durum

The Canadian durum crop has grown through harvest as later estimates point towards a larger crop. Provincial reports point to the crop being larger than Statistics Canada with Saskatchewan provincial crop report pointing to a 41 bpa average for durum vs a 33 bpa average just one year ago. Market prices have stabilized recently, and export pace has kept up to last year’s pace so far. Production is expected widely within the market to surpass Statistics Canada’s 6.5 mmt crop. Crop prices domestically have stabilized and are seeing crop prices in the $7.50 to $7.75 per bushel range across Saskatchewan and have picked up around $0.25 per bushel over the past month. Global import demand is expected to drop from 9.2 mmt last year to 8.6 mmt this year, larger global production being penciled in at 37.2 mmt vs last year’s 36.4 mmt of which Canada will account for 6.5 mmt of that. The EU crop is at 8.3 mmt vs 7.2 mmt last year. Ending stocks, this year are expected globally at 7.5 mmt vs 6.7 mmt last year and Canadian durum will need to be competitive. Early exports of Canadian durum have been strong and pricing well into EU and North Africa. We are watching this trend closely and keeping an eye on export shipments in a proactive manner to analyse the movements.

CASH MARKETS

Markets looking for a demand story as many key exporting nations exports are behind pace. Reports of buyers awaiting on the sidelines as demand needs are not immediate and can afford to play out the markets for the time being. Major news at this point needs to come from demand as market understands supply side already. Cash markets mixed but in general steadier in recent weeks as futures markets continue to struggle to find any true support.

GLOBAL PURCHASES AND TENDERS

- Saudi Arabia was in for a large sum of wheat last week. 420,000 tonnes of milling wheat was sought for the nation and Russia will be the main exporter along with some other Black Sea origin. The wheat requested is 12.5 per cent protein and was bid at $263.38 c&f for December/January arrival.

- Tunisia tendering for 100,000 mt of milling wheat for November and December shipment.

- Jordan is expected to tender for 120,000 mt of milling wheat, October 14.

- Bangladesh purchased 220,000 metric tonnes of U.S. wheat for a reported $308 per tonne this past week.

- South Korea reportedly tendering for 95,000 tonnes of milling wheat for December and January shipment. Tenders close October 15.

- Algeria expected to tender for 50,000 tonnes of durum this week.

FUTURES MARKETS

Futures continue to carve out their lows and find themselves near the bottom end of their 52-week trading range. Harvest pressure and lack of bullish fundamental stories keeping market trends unchanged. CFTC Commitment of Traders Data not available due to U.S. government shutdown. Last available data below.

Seasonal Charts – Minneapolis Spring Wheat – Average (Green Line) Current Year (Black Line)

Seasonal Charts – Chicago Wheat – Average (Green Line) Current Year (Black Line)