Wheat Market Outlook and Prices

The Wheat Market Outlook is provided by Exceed Grain Marketing.

Wheat Market Outlook – October 7, 2024

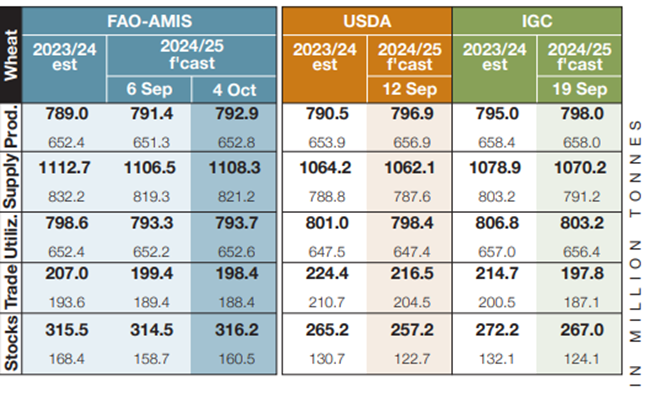

AMIS October 2024 Market Monitor

Source: AMIS

- In its October Market Monitor, AMIS increased global wheat production by 1.5 million mt from its September forecast. The increase in production was the result of larger production in Australia and Ukraine offsetting smaller crops in the EU.

- Wheat use was raised to a fresh record of 535.6 million mt, driven by large use for both food and industrial purposes.

- Global trade was reduced by 1 million mt. Egypt is expected to import 0.5 million mt less wheat than last month and exports from the EU were reduced by another 2 million mt.

- Ending stocks were raised by 1.7 million mt from last month. More stocks in Australia, the EU and Ukraine are expected to offset smaller stocks in Russia. Global ending stocks of 316.2 million mt are now expected to be 0.7 million mt more than last year.

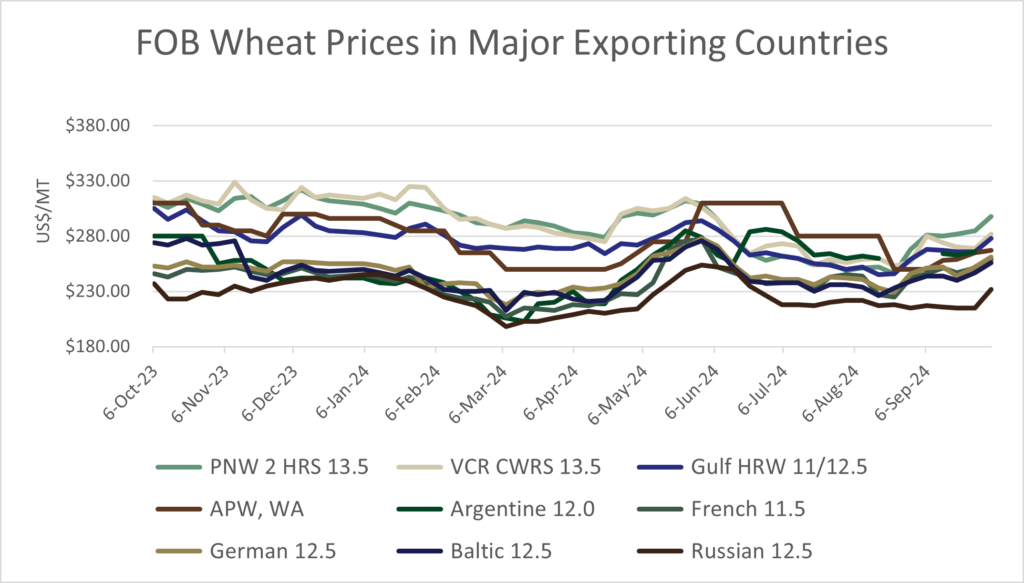

FOB Cash Values

Source: Mercantile

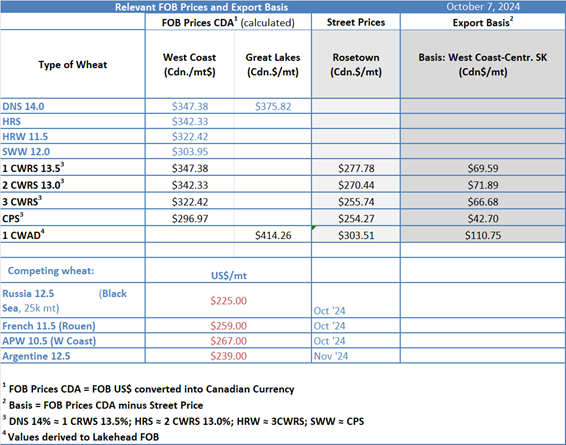

- Global cash wheat prices continued to follow Russian prices higher last week. We have Russian FOB wheat at $225/mt, up $9/mt from last week.

Global Wheat Production and Trade

There is a lot of competition in the wheat markets as wheat is produced around the world. Below is a brief synopsis on last week’s market events in the major wheat origins.

Futures

- 2024 contract Chicago winter wheat closed at $589-6, down 13-6 cents on Friday, up 9-6 cents on the week.

- 2024 contract Kansas winter wheat closed at $598-0, down 13-4 cents on Friday, up 21-2 cents on the week.

- 2024 Minneapolis hard red spring wheat closed at $638-4, down 7-6 cents on Friday, up 30-2 cents on the week.

- Southern wheat futures are currently trading 2-3 cents higher at the time of writing.

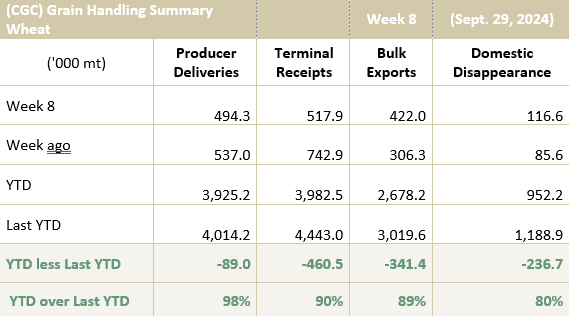

Canadian Wheat

- Sask Ag raised its average provincial spring wheat yield estimate to 46 bushels per acre (bpa) vs 45 bpa previously. Meanwhile, Alberta Agriculture lowered its provincial yield estimate by almost a bushel to 45.4 bpa. We calculate that the combined changes lifted the average yield of the Canadian spring wheat crop to ~49.3 bpa which is slightly below Statistics Canada’s estimate.

- Canadian exports were strong in week eight at 422.0k mt, but total exports are now 11 per cent behind last year at 2.7 million mt. The average seasonal pace to date is 334.8k mt per week compared to the average pace of 406.2k mt per week needed to meet the AAFC’s 20.55 million mt export estimate.

Source: Mercantile, based on CGC data

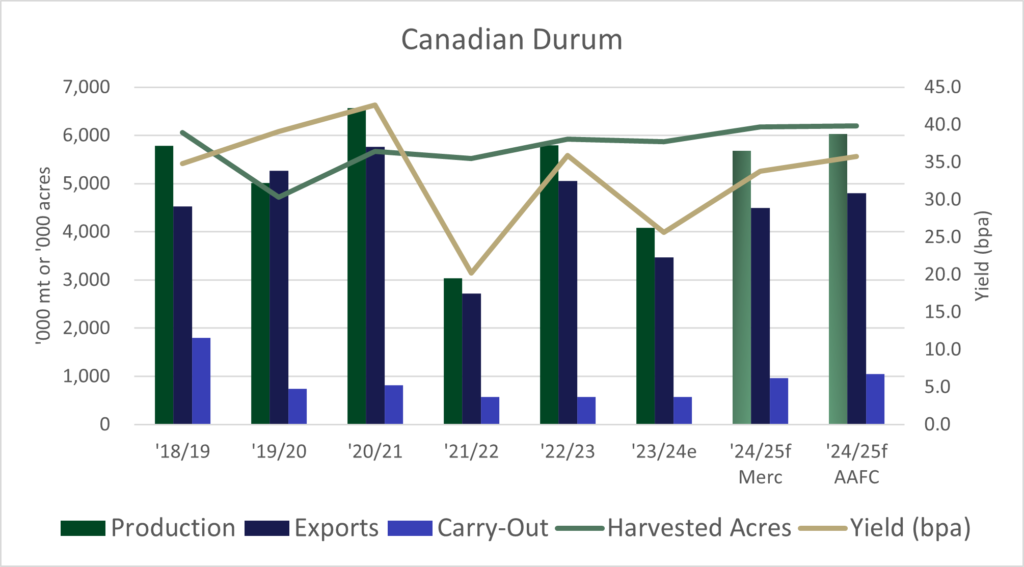

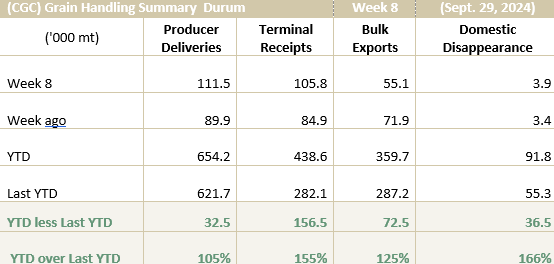

Canadian Durum

- Sask Ag lowered its durum yield estimate by a bushel to 32 bushels per acre.

- We talked last week about the AAFC’s revisions to the durum balance sheet. Ironically, the changes largely brought the AAFC’s numbers closer to our estimates. However, this does not solve the problem of the erroneous early signals given to growers by AAFC.

- The AAFC carry-in is now 576k mt compared to our estimate of 589k mt. Our numbers diverge regarding this year’s production. The AAFC is using an average yield of 35.7 bpa which, we believe, is too high. Given the provincial yield estimates, we calculate the average yield will be closer to 34 bpa. So, we are expecting a 5.7 million mt crop, while the AAFC is expecting a 6 million mt crop. The differences in production are resolved in the demand numbers as both Mercantile and the AAFC are expecting a carry-out of around 1 million mt, up ~65 per cent from last year.

Source: Mercantile, based on AAFC, STC, SK Ag, AB Ag, and Mercantile data

- Canadian durum exports in week eight were 55.1k mt for a season total of 359.7k mt, up 25 per cent from last year. Most of the durum exports in week eight were through the St. Lawrence and through land ports (to the U.S. and/or Mexico).

Source: Mercantile, based on CGC data

Global Durum

- CIF prices of durum wheat in Spain and Greece were 10-15 Euros/mt higher over the past two weeks to 310-320 Euros/mt. Despite this, Spain and Greece remain the cheapest origins into Southern Italy.

- The durum market will be better supplied this year and there will be strong competition in the export market.

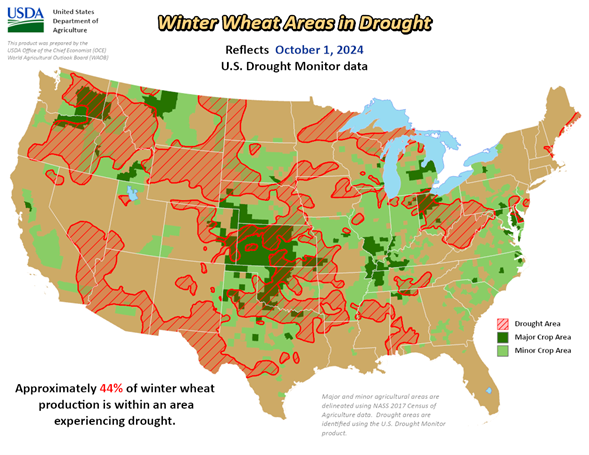

U.S. Wheat

- S. wheat futures moved higher on the week. Dryness in the Black Sea and the U.S. winter wheat belt, as well as tensions in the Middle East supported prices.

- Weekly U.S. wheat sales were above trade expectations at 443.7k mt. Total commitments are now 14.7 million mt. This is 17 per cent ahead of last year and over half of the USDA’s total export estimate.

- Winter wheat seeding advanced 14 points over the week to 39 per cent complete. The winter wheat belt remains dry. Approximately 44 per cent of the total U.S. winter wheat area is under drought conditions. Fourteen per cent of the crop has emerged, which is slightly ahead of average. USDA has not begun condition ratings yet.

- U.S. Hard Red Spring (HRS) for Nov. 2024 is valued at $298.00mt FOB Pacific Northwest (PNW) (up $13.00/mt from last week), FOB Gulf Hard Red Winter (HRW) 12/13.5 pro is valued at $295.00/mt (up $22.00/mt from last week); Gulf HRW 11/12.5 pro is at $278.00/mt (up $12.00/mt from last week).

Australian Wheat

- Dry conditions and frost damage have some analysts decreasing their forecasts for Australia’s wheat crop. Crop estimates are ranging from 27-33 million mt. Some of the lower estimates in that range came out last week. The official estimate from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is 31.8 million mt.

- FOB values in Australia: Nov. 2024 Australian Premium White Wheat (APW), Western Australia was valued at $267.00/mt (up $2.00/mt from last week).

Argentine Wheat

- Condition ratings were unchanged in Argentina at 36 per cent Gd/Ex. Buenos Aires Grain Exchange (BAGE) is expecting an 18.6 million mt crop. The crop continues to suffer under dry conditions, but there might be some relief in the coming weeks.

- FOB Argentine 12 pro wheat upriver for Dec. 2024 is $239.00/mt.

EU Wheat

- French wheat futures rose to an 11-week high last week. Rising prices in Russia caused funds to cover short positions.

- Farmers continue to be reluctance sellers. The rising prices have not convinced them to sell after what is estimated to be the smallest wheat harvest in 11 years.

- EU FOB prices: 2024 French 11 pro wheat closed at $259.00/mt (up $8.00/mt from last week); Nov. 2024 German 12.5 pro wheat closed at $261.00 (up $8.00/mt from last week); Nov. 2024 Baltic 12.5 pro wheat closed at $256.00/mt (up $9.00/mt from last week).

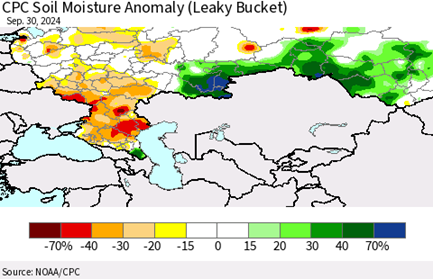

Black Sea Wheat

- Russia exported 9.5 million mt of wheat in July-Aug. This is only 200k mt less than the record export volume set in the same period last year. Despite this, SovEcon reduced its forecast for Russian exports by 0.5 million mt. The smaller export estimate may stem from calls for the Russian government to restrict exports as dryness is hurting production of the upcoming crop.

- Russian wheat prices rose to a three-month high last week as dryness in Russia’s main winter wheat growing region continues to cause concern. September was the seventh consecutive month with below average rain fall.

- We have Russian FOB values for 12.5 per cent protein wheat for Nov. 2024 at $232.00/mt (up $9.00/mt from last week).

Significant Purchases/Trades

-

- The much-anticipated Saudi Arabia wheat tender results were released today. Preliminary results indicate Saudi Arabia bought 307k mt of Dec.-Jan. wheat at $265.78/ cost and freight (CFR).

- U.S. export sales were 443.7k mt for a season total of 14.7 million mt.

Significant Events

- Turkey will reportedly replace its current wheat import ban with a formula-based system. Turkish mills must buy 85 per cent of its wheat from the Turkish Grain Board (TMO) and will be allowed to import the remining 15 per cent. This means that Turkey will likely import 2-5 million mt compared to the USDA’s current 7 million mt estimate.

- The Egyptian government has reportedly made a deal with an entity (“JV”) to make it responsible for sourcing of the country’s wheat. This is seemingly a step away from the General Authority for Supply Commodities (GASC) tender model.

- Egypt is looking at adding corn and sorghum into the flour used in its subsidized bread program. The proposal comes as the cash strapped country tries to find cheaper options for its bread program. If successful, sources say that upwards of one million mt of wheat could be substituted.

- A cargo of Ukrainian corn destined to Italy was hit by a Russian missile over the weekend. The vessel was in Ukraine’s port of Pivdennyi when it was hit.

Mercantile’s Weekly Outlook

Mercantile expects wheat futures will be mostly flat this week as the trade waits for the USDA report this Friday. Higher Russian wheat prices are supportive, but according to Mercantile, prices in competing origins were also higher which means Russia remains the cheapest wheat origin. Egypt’s attempts to reduce its reliance on wheat is not a demand issue, but rather a financing one. Mercantile would continue to hold sales for now.

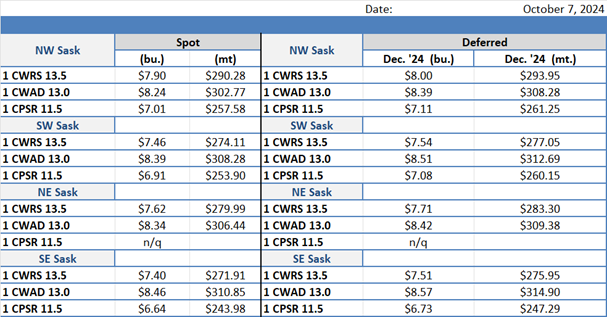

Canadian Primary Elevator Bids

in Canadian Dollars per Bu and per MILLION MT

Data source: PDQ, Oct. 7, 2024

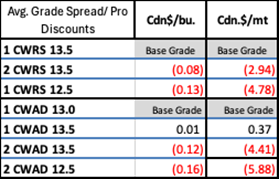

Grade Spreads

in Canadian Dollars per Bu and per MILLION MT

Data source: PDQ, Oct. 7, 2024

Relevant FOB Prices and Calculated Basis

U.S. & Canadian Dollars per MT

Disclaimer: The content of the Wheat Market Outlook Report and audio summary are the views and opinions of Mercantile Consulting and do not necessarily reflect the views and opinions of the Saskatchewan Wheat Development Commission.

PDF Download Wheat Market Outlook - October 7, 2024 October 7, 2024 Report