Wheat Market Outlook and Prices

The Wheat Market Outlook is provided by Exceed Grain Marketing.

Wheat Market Outlook – January 7, 2025

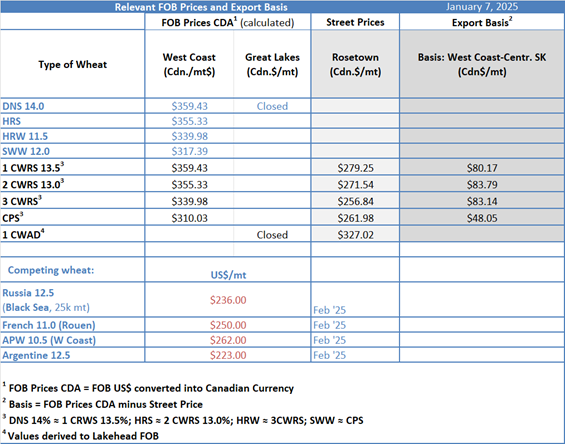

Year in Review: FOB Wheat Prices in Major Exporting Countries

Source: Mercantile

- 2024 was an interesting year in the cash markets. Cash prices started the year strong, and then rapidly declined as the market adjusted to the strong crops in the Northern Hemisphere.

- The cash markets were dominated by Russia which, until recently, had been posting consecutive record monthly export volumes. Near the end of the year the government started implementing measures to restrict exports.

- Weak currencies in importing nations and declining cash prices kept buyers limiting purchases to their immediate needs.

- We expect that 2025 will look markedly different than 2024 for a couple of reasons. The rising U.S. dollar will push importers away from the U.S., and towards origins with weaker currencies. Additionally, lower stocks in Russia and the EU, and potentially smaller production in Europe (winter wheat crops are weak in Russia and had a late start in France) will make importers rely on the abundant crops that were just harvested in the Southern Hemisphere.

- Over the course of the year, North American FOB values declined by $26.00-$46.00/mt. FOB values fell in Australia by $34.00/mt and in Argentina by $19.00/mt. Meanwhile, FOB values in Europe were anywhere from $4.00/mt lower (in Russia) to $5.00-$6.00/mt higher (in France and the Baltics).

Global Wheat Production and Trade

There is a lot of competition in the wheat markets as wheat is produced around the world. Below is a brief synopsis on last week’s market events in the major wheat origins.

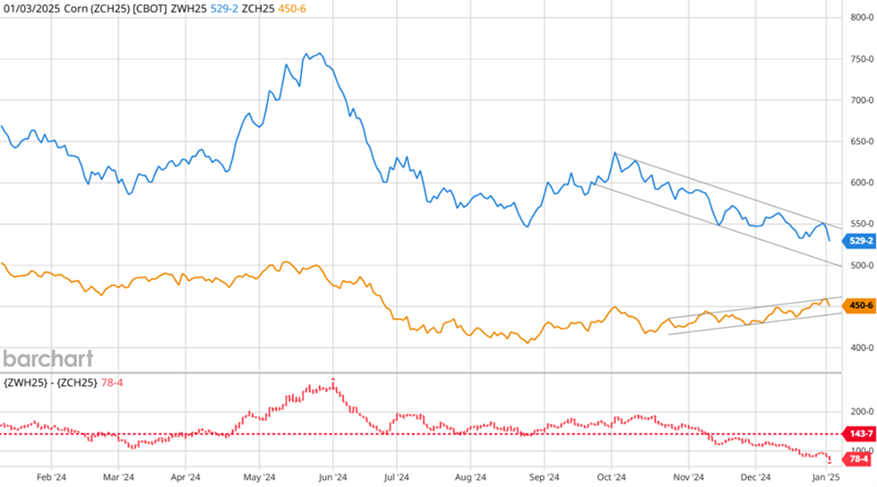

FUTURES

- Mar ‘25 contract Chicago winter wheat closed at $529-2, down 16-4 cents on Friday, down 11-6 cents on the week.

- Mar ‘25 contract Kansas winter wheat closed at $539-0, up down 12-6 cents on Friday, down 12-4 cents on the week.

- Mar ‘25 Minneapolis hard red spring wheat closed at $577-6, down 11-6 cents on Friday, down 16-2 cents on the week.

- U.S. wheat futures had a strong close on Monday and are currently trading 2-5 cents higher at the time of writing Tuesday morning.

Canadian Wheat

- March spring wheat contracts broke through the $5.85 support on Friday but regained this on Monday. We are currently testing the (blue) downward trend line which was established in June.

Source: Barchart

- On Friday, the Canadian dollar fell to $0.69235, which was the lowest close since the spring of 2003. Monday’s recovery brought us to $0.69930, and we are currently trading a little lower at $0.6910.

25-Year Canadian Dollar

Source: Barchart

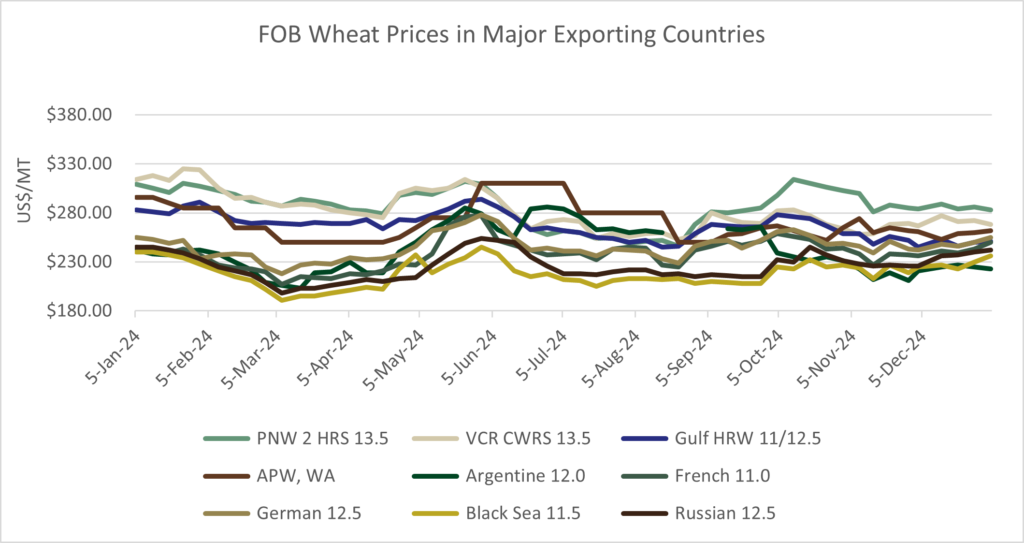

- Canadian non-durum wheat exports in week 21 ending Dec. 29, 2024 were 192.3k mt. The YTD total is 8.4 million mt. There was no data given for the previous year as the CGC usually combines week 21 and week 22 in a single report. We should have this data again next week. In week 20, total exports of 8.2 million mt were exactly in-line with last year.

Source: Mercantile, based on CGC data

Canadian Durum

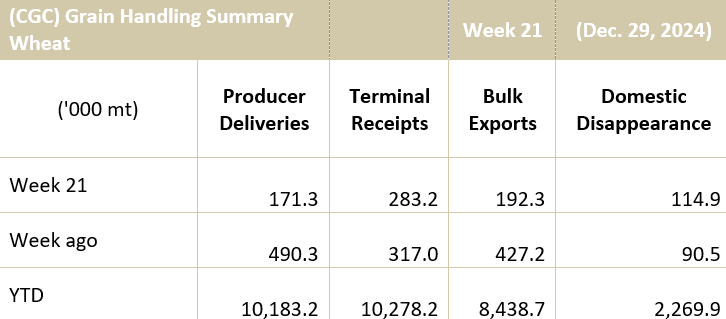

- Canadian durum exports in week 21 were 170.6k mt. The season total is now 2.3 million mt. As of week 20, durum exports were 79 per cent ahead of last year.

Source: Mercantile, based on CGC data

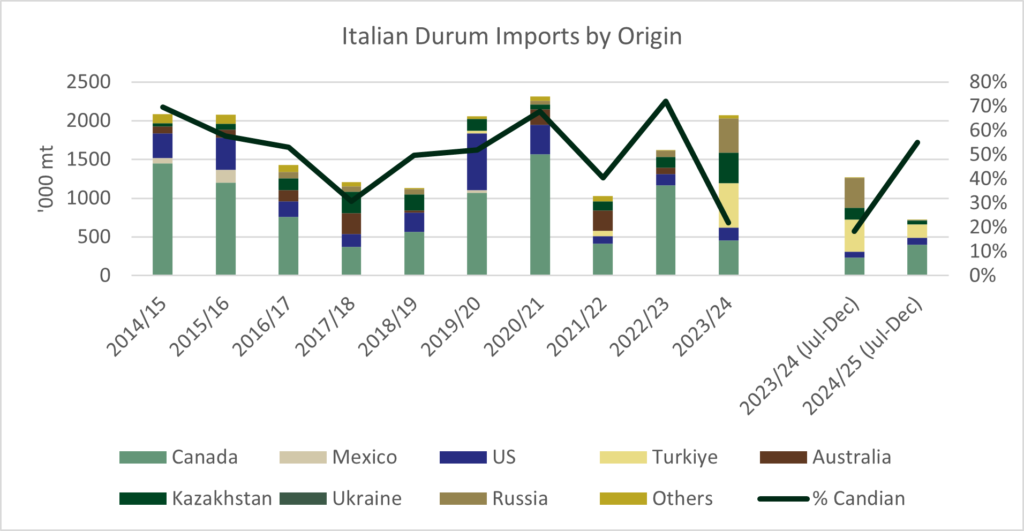

Global Durum

- Turkey extended its ban on durum wheat exports until May 31, 2025.

- Russia’s 2024 durum crop was said to be a record at 1.9 million mt. Domestic demand for high quality Russian durum is said to have grown from 800k mt to 950k mt. Most of the Russian durum quality is considered class 3 or 4, and little to no Russian durum makes class 1 or 2 on an average year (steps are being taken to change this). So, Russian durum rarely achieves a strong enough grade to compete with Canadian durum into the Italian market. With that said, Russia sold a record, 445k mt of durum to Italy (according to EUC data) during 2023. The Russian war and weak ruble put Russian durum at a steep discount to the relatively expensive Canadian durum.

- Italian Jul-Dec (extra-EU) durum imports are just 57 per cent of last year’s volume to date at 724k mt. Last year, Italy was importing large volumes of durum from Russia and Turkey. This year, durum exports from Turkey are being restricted and Russian grain exports are banned from the EU. Canada has regained its footing as the main supplier of durum to Italy at 55 per cent of the Jul-Dec total (compared to 18 per cent YTD last year).

Source: Mercantile, based on EUC and EU customs data

- We would target sales up to 55 per cent sold at $9.50-$10.00/bu depending on your location.

U.S. Wheat

- U.S. wheat futures were lower last week largely because of the strong U.S. dollar.

- The U.S. dollar rose to 108.8 on Friday. This is the strongest close since November 2022. The U.S. Federal Reserve has indicated it will be cautious with further cuts to the interest rates given the strong U.S. economy and strong job market data.

Five-Year U.S. Dollar

Source: Barchart

- Wheat sales for the week ending Dec. 26, 2024, were 140.6k mt. A marketing year low, and less than the 200k-500k range of expectations. Total commitments are now 16.9 million mt, 10 per cent ahead of last year compared to the USDA’s estimate for a 20 per cent increase.

- Wheat (blue) has become increasingly cheap to corn (orange). The wheat-corn spread (red) narrowed by 10 cents over the holidays to $0.78. This compares with the average $1.44 premium wheat has commanded over corn since October 2024.

Source: Barchart

- U.S. Hard Red Spring (HRS) for Feb. 2025 is valued at $283.00mt FOB Pacific Northwest (down $1.00/mt over the holidays). FOB Gulf Hard Red Winter (HRW) 12/13.5 pro is valued at $258.00/mt (up $4.00/mt over the holidays); Gulf HRW 11/12.5 pro is at $251.00/mt (up $5.00/mt over the holidays).

Australian Wheat

- Harvest in Australia is complete. Australian futures rose to two-month highs, and were closed before U.S. prices fell.

- FOB values in Australia: Feb. 2025 Australian Premium White Wheat (APW), WA was valued at $262.00/mt (up $3.00/mt over the holidays).

Argentine Wheat

- Harvest in Argentina rose to 95 per cent complete. Buenos Aires Grain Exchange (BAGE) let its production estimate unchanged at 18.6 million mt. Cash prices in Argentina fell $4.00/mt over the Christmas holidays and remain the cheapest in the world on a FOB basis. Argentina’s wheat exports are running at a three-year high.

- FOB Argentine 12 pro wheat upriver for Feb. 2025 is $200/mt (down $4.00/mt over the holidays).

EU Wheat

- International futures market of France (MATIF) wheat futures rose to a two-month high as the euro lost value compared to the U.S. dollar. These gains were lost on Friday in sympathy to the declines in the U.S. wheat contracts.

- EU FOB prices: 2025 French 11 pro wheat closed at $250.00/mt (up $11.00/mt over the holidays); Feb. 2025 German 12.5 pro wheat closed at $255.00 (up $9.00/mt over the holidays); Feb. 2025 Baltic 12.5 pro wheat closed at $256.00/mt (up $9.00/mt over the holidays).

Black Sea Wheat

- SovEcon lowered its estimate for Russian 2024/25 wheat exports by 400k mt to 43.7 million mt. They expect exports in the 2025/26 season will be 36.4 million mt.

- The Russian state weather agency says 37 per cent of the Russian winter wheat crop is in poor condition.

- We have Russian FOB values for 12.5 per cent protein wheat for Feb. 2025 at $242.00/mt (up $5.00/mt over the holidays).

Significant Purchases/Trades

-

- Cash markets were quiet over the holidays.

Significant Events Over the Past Week

- Turkey extended its ban on durum exports until May 31, 2025. It increased its import quota on soft wheat, now allowing its mills to import 25 per cent of their needs vs 15 per cent previously. Turkey’s total 2024 wheat production (durum and sot wheat) was estimated at 20.8 million mt, down 5.5 per cent from last year

- Funds worked to buy in part of its short position over the holidays. The MATIF short shrank to 113k contracts.

- Egypt’s new state grain buying agency, MISR, received its first load of wheat on Dec. 30, 2024. The new agency had a slow start in fulfilling its duties to buy the country’s wheat given uncertainty and lack of clarity on payment and shipping terms. The vessel that arrived, however, was part of the Russian “ghost fleet”, which had participated in the shipping of stolen Ukrainian grain and does not actually add a whole lot of clarity to what is going on.

Mercantile’s Weekly Outlook

According to Mercantile, the rising U.S. dollar is having an increasingly large impact on trade flows as buyers switch away from the U.S. to origins with weaker currencies. Trade flows in 2025 will be notably different than in 2024. Mercantile says fewer exports from Europe (Russian and France) will send buyers to source from the abundant crops in the Southern Hemisphere (Australia and Argentina). The fundamentals heading into the new year are not necessarily bullish, but Mercantile says the funds currently hold a ~300k contract global short position in wheat (similar to this time last year) and will likely be prompted to buy it back in the next six months. – Mercantile would hold sales for now.

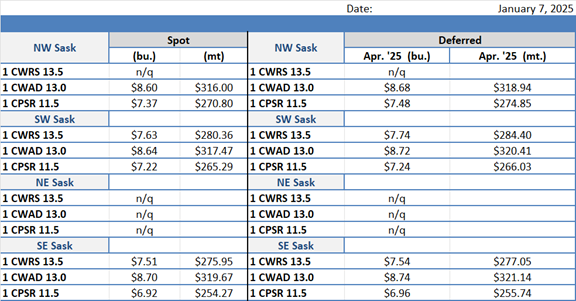

Canadian Primary Elevator Bids

in Canadian Dollars per Bu and per MILLION MT

Data source: PDQ, Jan 7, 2025

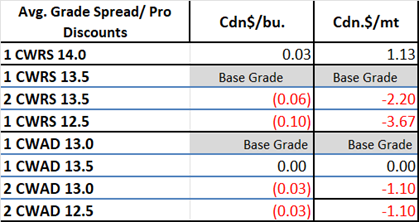

Grade Spreads

in Canadian Dollars per Bu and per MILLION MT

Data source: PDQ, Jan 7, 2025

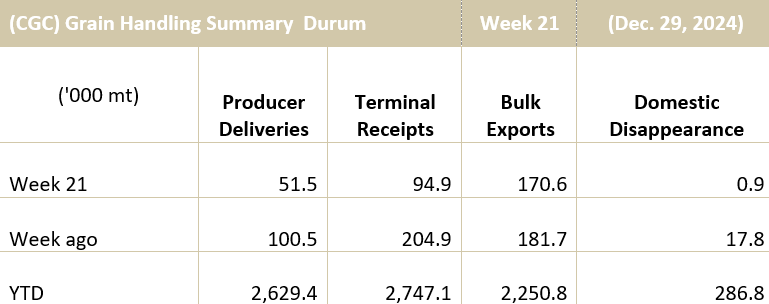

Relevant FOB Prices and Calculated Basis

U.S. & Canadian Dollars per MT

PDF Download Wheat Market Outlook - January 7, 2025 January 7, 2025 Report